Question: Mostly need help on C and D. Please show cell references. This trial balance does not reflect May's month-end-close. No day-to-day transactions were recorded in

Mostly need help on C and D. Please show cell references.

Mostly need help on C and D. Please show cell references.

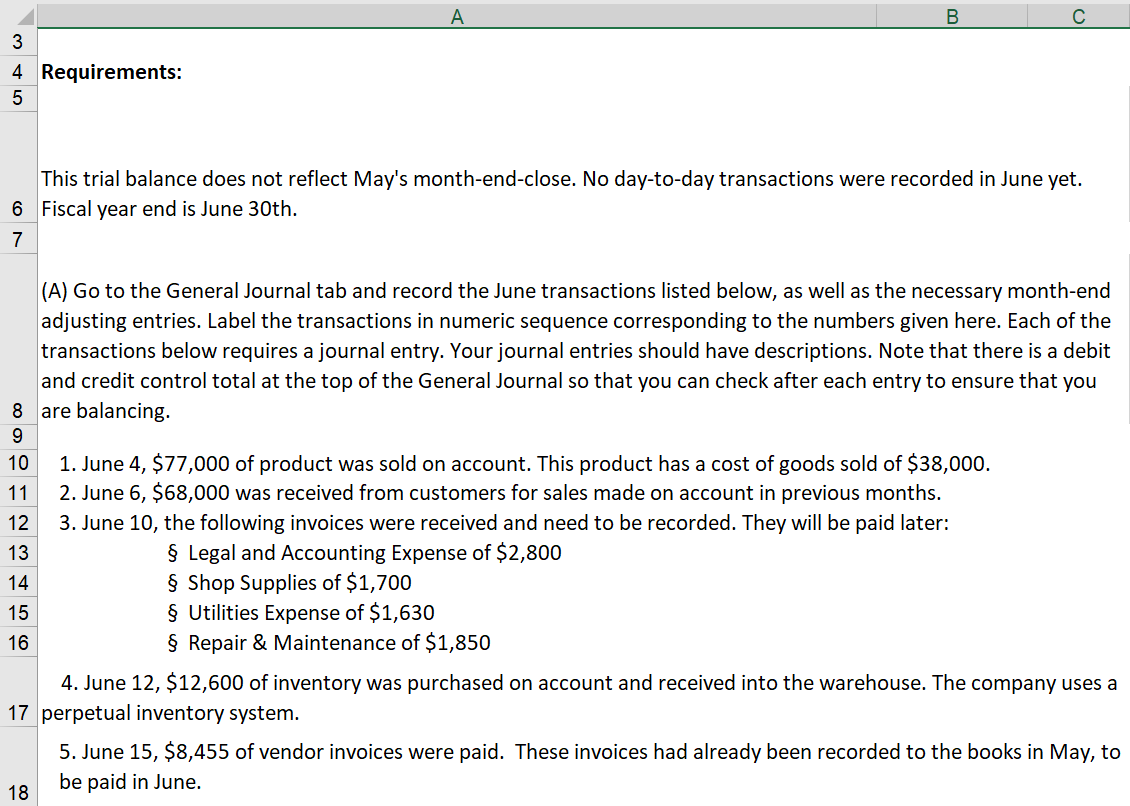

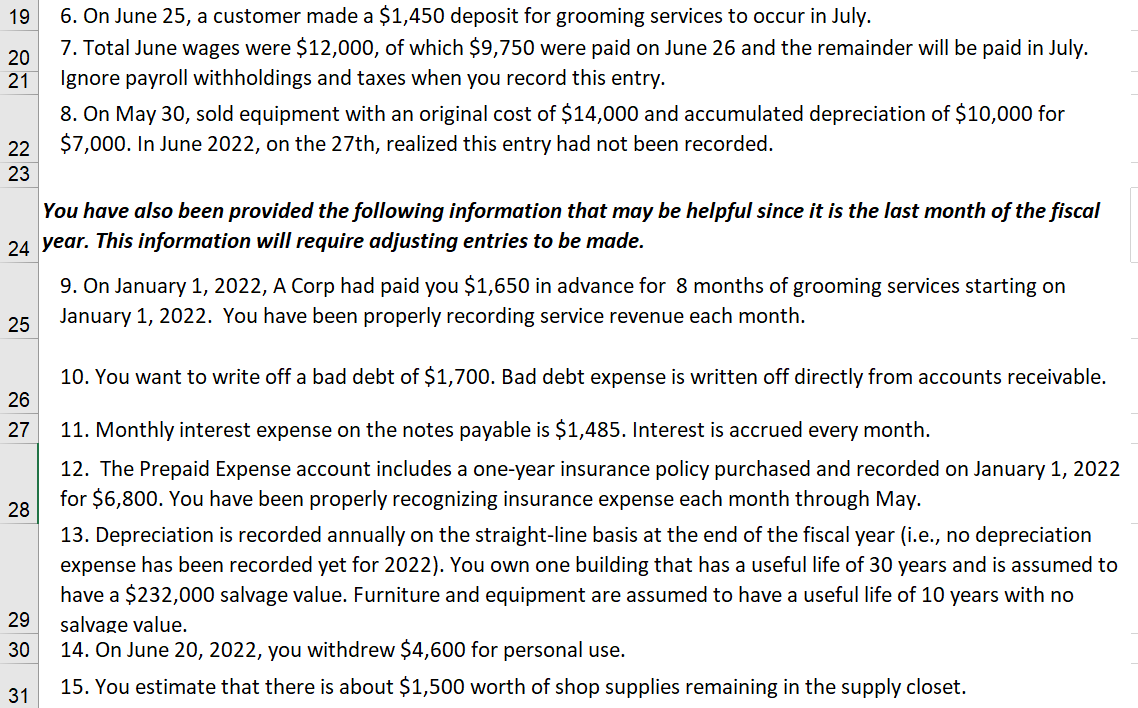

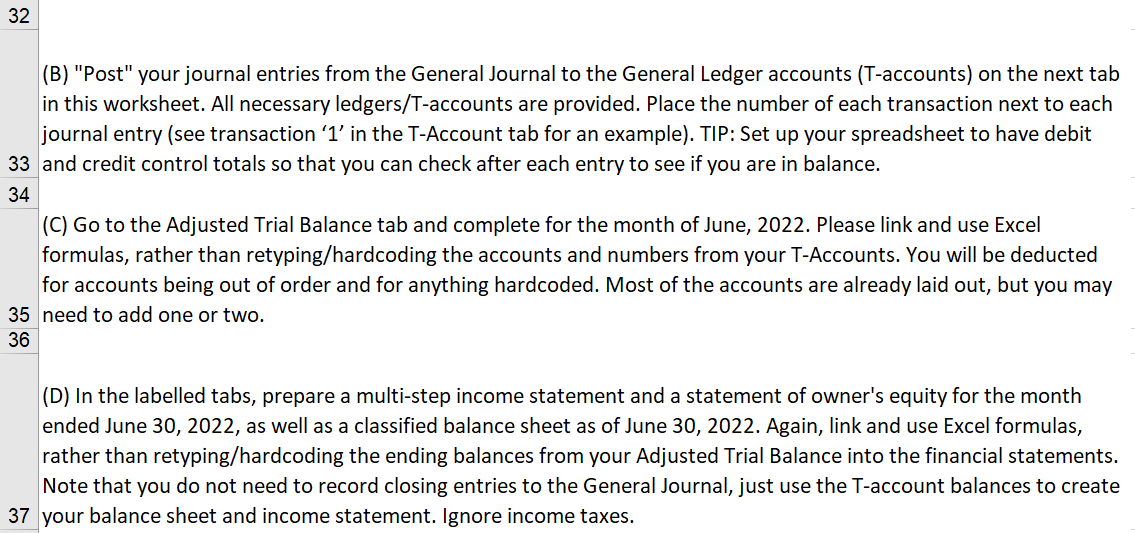

This trial balance does not reflect May's month-end-close. No day-to-day transactions were recorded in June yet. Fiscal year end is June 30th. (A) Go to the General Journal tab and record the June transactions listed below, as well as the necessary month-end adjusting entries. Label the transactions in numeric sequence corresponding to the numbers given here. Each of the transactions below requires a journal entry. Your journal entries should have descriptions. Note that there is a debit and credit control total at the top of the General Journal so that you can check after each entry to ensure that you are balancing. 1. June 4, $77,000 of product was sold on account. This product has a cost of goods sold of $38,000. 2. June 6, $68,000 was received from customers for sales made on account in previous months. 3. June 10, the following invoices were received and need to be recorded. They will be paid later: Legal and Accounting Expense of $2,800 Shop Supplies of $1,700 Utilities Expense of $1,630 Repair \& Maintenance of $1,850 4. June 12,$12,600 of inventory was purchased on account and received into the warehouse. The company uses a perpetual inventory system. 5. June 15,$8,455 of vendor invoices were paid. These invoices had already been recorded to the books in May, to be paid in June. 6. On June 25 , a customer made a $1,450 deposit for grooming services to occur in July. 7. Total June wages were $12,000, of which $9,750 were paid on June 26 and the remainder will be paid in July. Ignore payroll withholdings and taxes when you record this entry. 8. On May 30, sold equipment with an original cost of $14,000 and accumulated depreciation of $10,000 for $7,000. In June 2022 , on the 27 th, realized this entry had not been recorded. You have also been provided the following information that may be helpful since it is the last month of the fiscal rear. This information will require adjusting entries to be made. 9. On January 1, 2022, A Corp had paid you $1,650 in advance for 8 months of grooming services starting on January 1,2022 . You have been properly recording service revenue each month. 10. You want to write off a bad debt of $1,700. Bad debt expense is written off directly from accounts receivable. 11. Monthly interest expense on the notes payable is $1,485. Interest is accrued every month. 12. The Prepaid Expense account includes a one-year insurance policy purchased and recorded on January 1, 2022 for $6,800. You have been properly recognizing insurance expense each month through May. 13. Depreciation is recorded annually on the straight-line basis at the end of the fiscal year (i.e., no depreciation expense has been recorded yet for 2022). You own one building that has a useful life of 30 years and is assumed to have a $232,000 salvage value. Furniture and equipment are assumed to have a useful life of 10 years with no salvage value. 14. On June 20, 2022, you withdrew $4,600 for personal use. (B) "Post" your journal entries from the General Journal to the General Ledger accounts (T-accounts) on the next tab in this worksheet. All necessary ledgers/T-accounts are provided. Place the number of each transaction next to each journal entry (see transaction ' 1 ' in the T-Account tab for an example). TIP: Set up your spreadsheet to have debit and credit control totals so that you can check after each entry to see if you are in balance. (C) Go to the Adjusted Trial Balance tab and complete for the month of June, 2022. Please link and use Excel formulas, rather than retyping/hardcoding the accounts and numbers from your T-Accounts. You will be deducted for accounts being out of order and for anything hardcoded. Most of the accounts are already laid out, but you may need to add one or two. (D) In the labelled tabs, prepare a multi-step income statement and a statement of owner's equity for the month ended June 30, 2022, as well as a classified balance sheet as of June 30, 2022. Again, link and use Excel formulas, rather than retyping/hardcoding the ending balances from your Adjusted Trial Balance into the financial statements. Note that you do not need to record closing entries to the General Journal, just use the T-account balances to create your balance sheet and income statement. Ignore income taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts