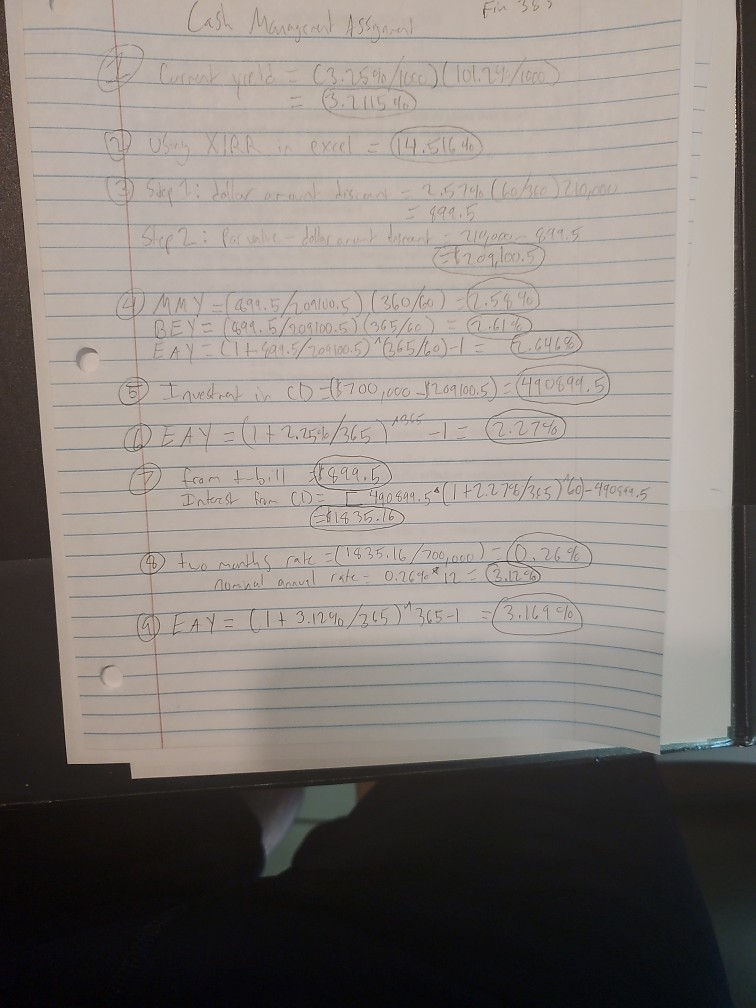

Question: mostly need help on number 6 and 9. thanks in advance! this is what I have so far. excuse the handwriting Cash Management Assignment 1.

mostly need help on number 6 and 9. thanks in advance!

this is what I have so far. excuse the handwriting

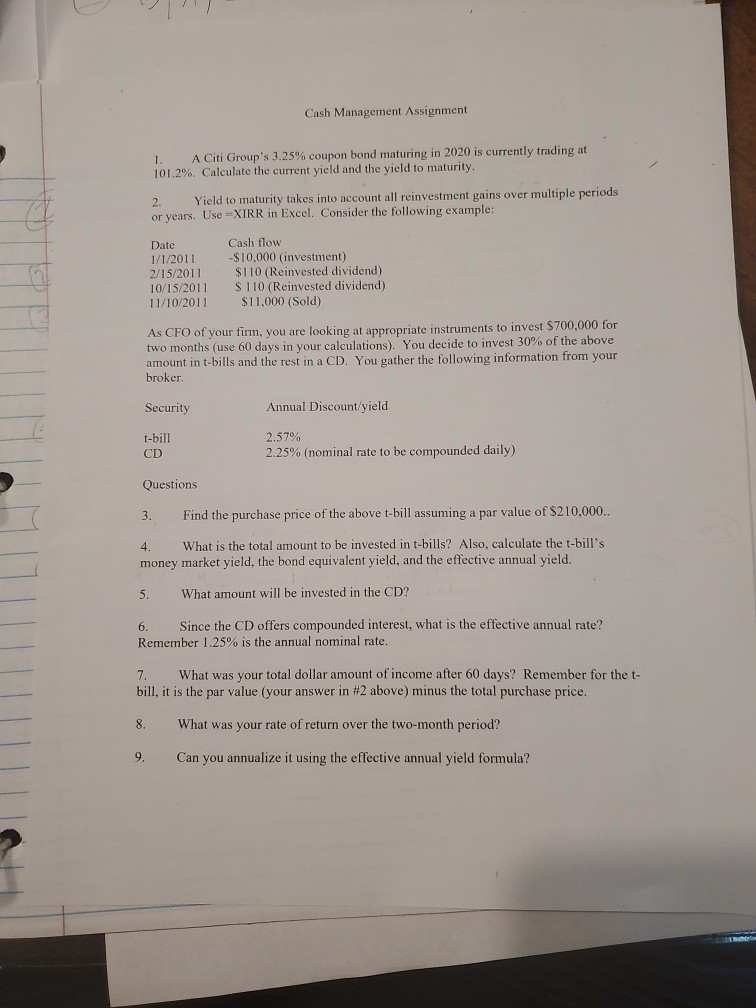

Cash Management Assignment 1. 101.2% A Citi Group's 3.25% coupon bond maturing in 2020 is currently trading at Calculate the current yield and the yield to maturity. 2. Yield to maturity takes into account all reinvestment gains over multiple periods or years. Use XIRR in Excel. Consider the following example: Date 1/1/2011 2/15/2011 10/15/2011 11/10/2011 Cash flow $10,000 (investment) $110 (Reinvested dividend) S 110 (Reinvested dividend) $11,000 (Sold) As CFO of your firm, you are looking at appropriate instruments to invest $700,000 for two months (use 60 days in your calculations). You decide to invest 30% of the above amount in t-bills and the rest in a CD. You gather the following information from your broker Security Annual Discount/yield t-bill CD 2.57% 2.25% (nominal rate to be compounded daily) Questions 3. Find the purchase price of the above t-bill assuming a par value of $210,000.. What is the total amount to be invested in t-bills? Also, calculate the t-bill's money market yield, the bond equivalent yield, and the effective annual yield. 5. What amount will be invested in the CD? 6. Since the CD offers compounded interest, what is the effective annual rate? Remember 1.25% is the annual nominal rate. 7. What was your total dollar amount of income after 60 days? Remember for the t- bill, it is the par value (your answer in #2 above) minus the total purchase price. 8. What was your rate of return over the two-month period? 9. Can you annualize it using the effective annual yield formula? - Lash Management Assignment R in excel - 14.516 40 ollar arant discount - 2,57% (hohco) 210,000 C1209,00 MMY (899.5/09100.5) (360/60) 2.58%) BEYE (694.5209100.5) 365/00) = 2.61 EAY = [lt 499.5/204100.5) ^ (265/60-1 = 6.646%) & Investment in CO (8700,000 -8 209 100,5) = (490699,5 @ EAY = (1 + 2,2596/365 ) A365 -|- (2.27%) I Interest from CD = I 490899, 50(1+2.279/365) 20-490562 @ two months rate =(1635,16/700,000) = 0,26% I nominal annuel rate - 0.26% 12 = (3.126 @ EAY = (1 + 3. 1290/265 )*365-1 = (3.169 %) Cash Management Assignment 1. 101.2% A Citi Group's 3.25% coupon bond maturing in 2020 is currently trading at Calculate the current yield and the yield to maturity. 2. Yield to maturity takes into account all reinvestment gains over multiple periods or years. Use XIRR in Excel. Consider the following example: Date 1/1/2011 2/15/2011 10/15/2011 11/10/2011 Cash flow $10,000 (investment) $110 (Reinvested dividend) S 110 (Reinvested dividend) $11,000 (Sold) As CFO of your firm, you are looking at appropriate instruments to invest $700,000 for two months (use 60 days in your calculations). You decide to invest 30% of the above amount in t-bills and the rest in a CD. You gather the following information from your broker Security Annual Discount/yield t-bill CD 2.57% 2.25% (nominal rate to be compounded daily) Questions 3. Find the purchase price of the above t-bill assuming a par value of $210,000.. What is the total amount to be invested in t-bills? Also, calculate the t-bill's money market yield, the bond equivalent yield, and the effective annual yield. 5. What amount will be invested in the CD? 6. Since the CD offers compounded interest, what is the effective annual rate? Remember 1.25% is the annual nominal rate. 7. What was your total dollar amount of income after 60 days? Remember for the t- bill, it is the par value (your answer in #2 above) minus the total purchase price. 8. What was your rate of return over the two-month period? 9. Can you annualize it using the effective annual yield formula? - Lash Management Assignment R in excel - 14.516 40 ollar arant discount - 2,57% (hohco) 210,000 C1209,00 MMY (899.5/09100.5) (360/60) 2.58%) BEYE (694.5209100.5) 365/00) = 2.61 EAY = [lt 499.5/204100.5) ^ (265/60-1 = 6.646%) & Investment in CO (8700,000 -8 209 100,5) = (490699,5 @ EAY = (1 + 2,2596/365 ) A365 -|- (2.27%) I Interest from CD = I 490899, 50(1+2.279/365) 20-490562 @ two months rate =(1635,16/700,000) = 0,26% I nominal annuel rate - 0.26% 12 = (3.126 @ EAY = (1 + 3. 1290/265 )*365-1 = (3.169 %)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts