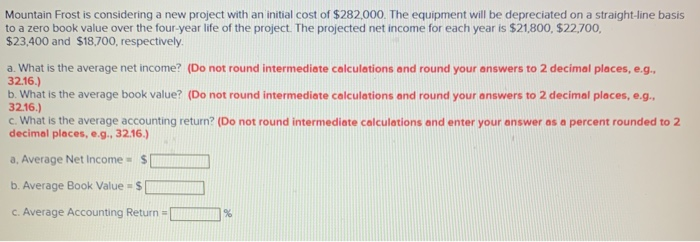

Question: Mountain Frost is considering a new project with an initial cost of $282,000. The equipment will be depreciated on a straight-line basis to a zero

Mountain Frost is considering a new project with an initial cost of $282,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $21,800, $22,700, $23,400 and $18,700, respectively. a. What is the average net income? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g.. 32.16.) b. What is the average book value? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the average accounting return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average Net Income - $ b. Average Book Value = $ c. Average Accounting Return = HARI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts