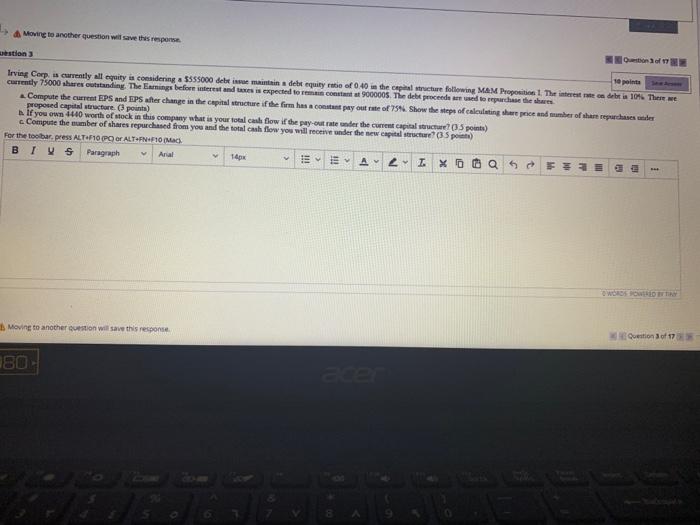

Question: Moving to another question will save the response estions Irving Corp. is currently all equity is considering SS55000 debt in main debe equity ratio of

Moving to another question will save the response estions Irving Corp. is currently all equity is considering SS55000 debt in main debe equity ratio of 0.40 in the patructure following MAM Proposition the interest in debt is 10%. There we Cently 75000 shares outstanding. The Eags before and is expected to come 9000005. The del proceeded to purchase the shoes Compute the current EPS and EPS after change in the capital structure of the form has a content pay out rate of 75% Show the steps of calculating the price and her of share repurchases under proposed capital structure points) if you own 1440 worth of stock in this company what is your total cash flow if the py-outer the capital points) cCompute the number of shares repurchased from you and the total cash flow you will need the new capital (35p) For the toolbar, press ALT 10 PO O ALTFN 10 Mac). BIVS Paragraph Anal 14px IEE AIXO O QF v Moving to another question will save this response Question of 17 180)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts