Question: > & Moving to another question will save this response. Question 47 of 50 Question 47 4.4 points Save Answer Candy Cane Inc. is considering

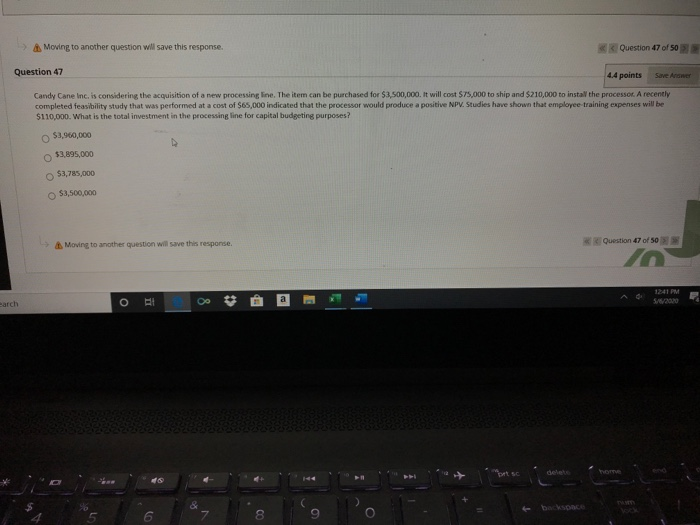

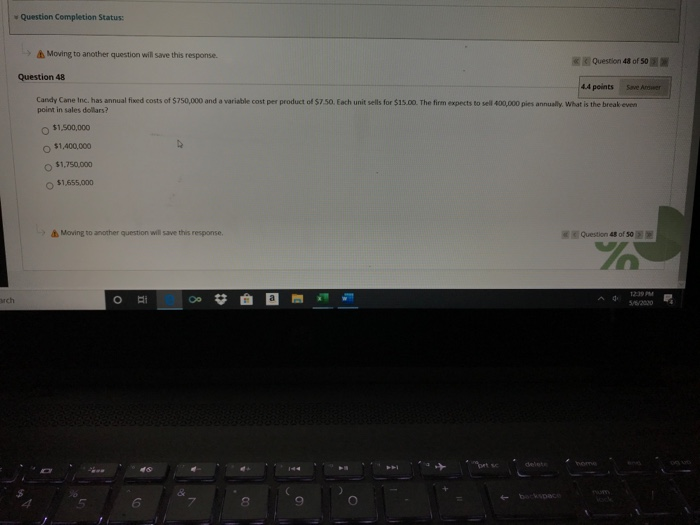

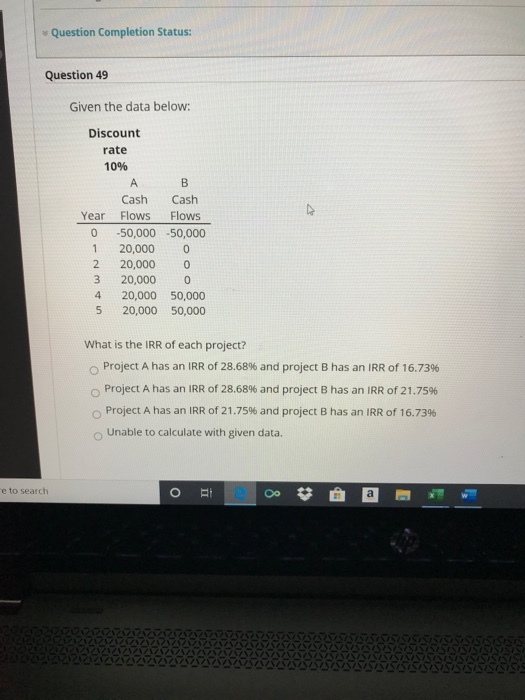

> & Moving to another question will save this response. Question 47 of 50 Question 47 4.4 points Save Answer Candy Cane Inc. is considering the acquisition of a new processing line. The item can be purchased for $3,500,000. It will cost $75,000 to ship and $210,000 to install the processor. A recently completed feasibility study that was performed at a cost of $65,000 indicated that the processor would produce a positive NPV. Studies have shown that employee training expenses will be $110,000. What is the total investment in the processing line for capital budgeting purposes? $3,960,000 53.895,000 $3,785,000 $3,500,000 -> Moving to another question will save this response Question 47 of 50 Barch Question Completion Status: Moving to another question will save this response. Question 48 of 50 Question 48 4.4 points Candy Cane Inc. has annual fixed costs of $750,000 and a variable cost per product of $7.50. Each unit sells for $15.00. The firm expects to sell 400,000 pies annually. What is the break even point in sales dollars? $1,500,000 $1,400,000 $1,750,000 $1,655.000 Moving to another question will save this response Question 48 of 50 ch Question Completion Status: Question 49 Given the data below: Discount rate 10% Cash Cash Year Flows Flows O -50,000 -50,000 20,000 0 2 20,0000 320,0000 4 20,000 50,000 5 20,000 50,000 What is the IRR of each project? Project A has an IRR of 28.68% and project B has an IRR of 16.7396 Project A has an IRR of 28.68% and project B has an IRR of 21.75% Project A has an IRR of 21.75% and project B has an IRR of 16.7396 Unable to calculate with given data. "e to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts