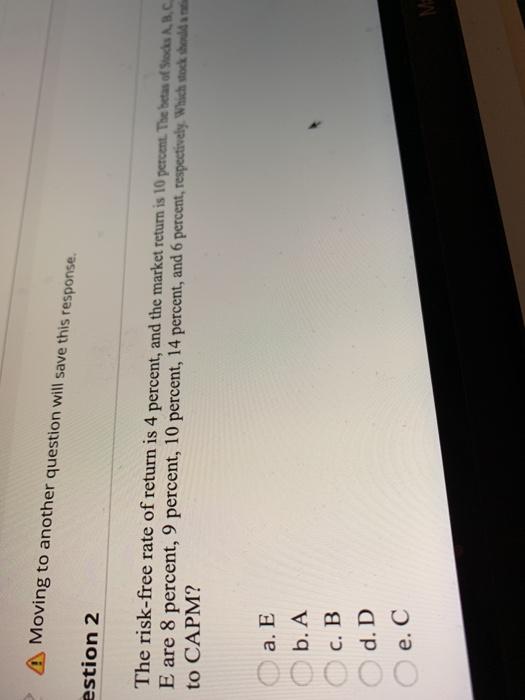

Question: Moving to another question will save this response. estion 2 The risk-free rate of return is 4 percent, and the market return is 10 percent.

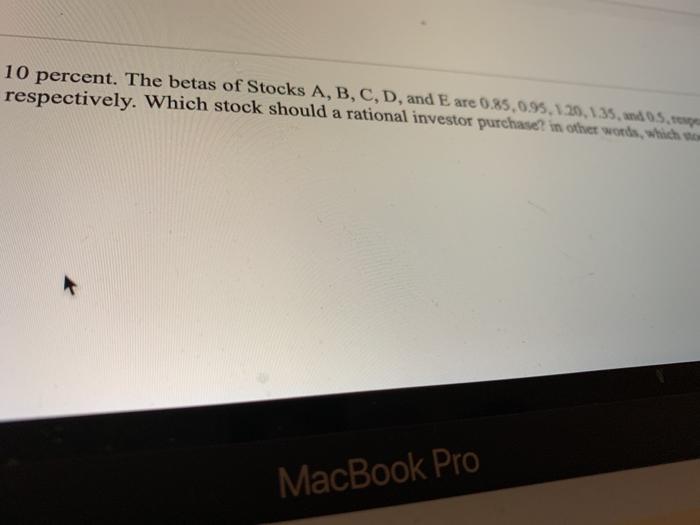

Moving to another question will save this response. estion 2 The risk-free rate of return is 4 percent, and the market return is 10 percent. The beas of Stads ABC E are 8 percent, 9 percent, 10 percent, 14 percent, and 6 percent, respectively. Which stock should not to CAPM? a. E b. A c. B d. D e. C MA 10 percent. The betas of Stocks A, B, C, D, and E are 0.85,095.120.1.35, and 05. respectively. Which stock should a rational investor purchase? in other words, which MacBook Pro Queen 2030 7 points 5, 0.95, 1.20, 1.35, and 0.5, respectively. The expected rates of return for Stocks A,B,C,D, and ase? in other words, which stock is correctly priced and has the right rate of return according Fook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts