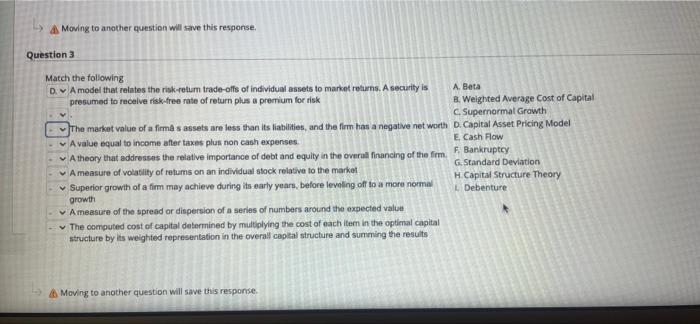

Question: Moving to another question will save this response. Match the following D. A model that relates the risk-retum trade-offs of individual assets to market returns.

Moving to another question will save this response. Match the following D. A model that relates the risk-retum trade-offs of individual assets to market returns. A security is presumed to receive risk-free rate of return plus a premium for risk A. Beta 8. Weighted Average Cost of Capital C. Supernormal Growth The market value of a firma s assets are less than its liabilities, and the firm has a negative net worth D. Capital Asset Pricing Model A value equal to income after taxes plus non cash expenses. E. Cash Flow A theory that addresses the relative importance of debt and equity in the overall financing of the firm. A measure of volatility of retums on an individual stock relative to the market F. Bankruptcy G.Standard Deviation H. Capital Structure Theory L Debenture Superior growth of a firm may achieve during its early years, before leveling off to a more normal growth A measure of the spread or dispersion of a series of numbers around the expected value The computed cost of capital determined by multiplying the cost of each item in the optimal capital structure by its weighted representation in the overall capital structure and summing the results Moving to another question will save this response. Question 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts