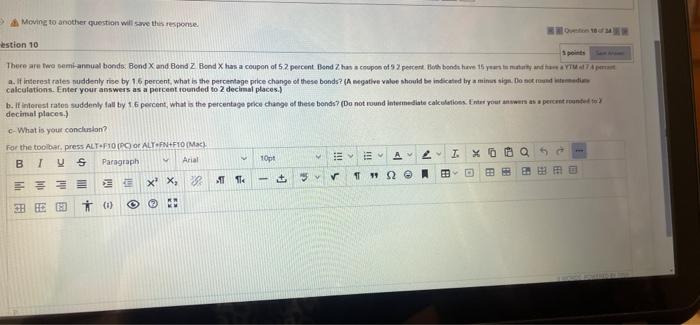

Question: Moving to another question will save this response. On 1834 estion 10 1 points There are two semi-annual bonds: Bond X and Bond Z. Bond

Moving to another question will save this response. On 1834 estion 10 1 points There are two semi-annual bonds: Bond X and Bond Z. Bond X has a coupon of 5.2 percent Bond 2 has a coupon of 92 percent. Both bonds hueve 15 years to maturity and have a YTM at 7A per a. If interest rates suddenly rise by 1.6 percent, what is the percentage price change of these bonds? (A negative valoe should be indicated by a minus sign. Do not round interdu calculations. Enter your answers as a percent rounded to 2 decimal places.) b. If interest rates suddenly fall by 1.6 percent, what is the percentage price change of these bonds? (Do not round intermediate calculations. Enter your answers as a percent rounded to decimal places.) c-What is your conclusion? For the toolbar, press ALT+F10 (PC) or ALT FN+F10 (Mac) V BIUS Paragraph V Arial 10pt EEEEA v I. X D 5 d 8130 5 FE E x' x ** (1) @X +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts