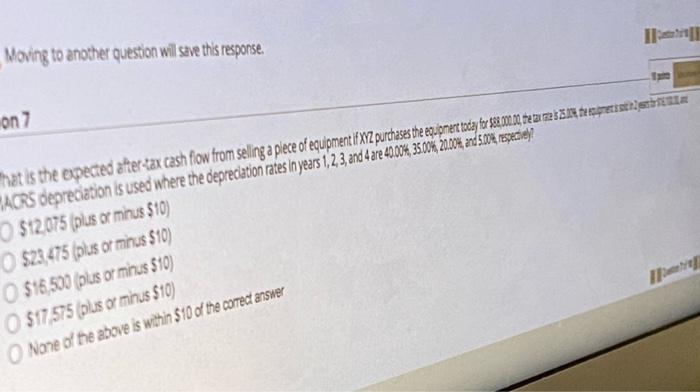

Question: Moving to another question will save this response. on 7 That is the expected after-tax cash flow from seling a piece of equipment if XYZ

Moving to another question will save this response. on 7 That is the expected after-tax cash flow from seling a piece of equipment if XYZ purchases the equipment today for sex 000 bez me te SHERIR SACRS depreciation is used where the depreciation rates in years 1, 2, 3, and 4 are 400, 35.004, 2004, and 51004 resetben $12.075 (plus or minus $10) $23,475 (plus or minus 510) $16.500 (pus or minus 510) $17,575 pus or minus $10) None of the above is within $10 of the correct answer Moving to another question will save this response. on 7 That is the expected after-tax cash flow from seling a piece of equipment if XYZ purchases the equipment today for sex 000 bez me te SHERIR SACRS depreciation is used where the depreciation rates in years 1, 2, 3, and 4 are 400, 35.004, 2004, and 51004 resetben $12.075 (plus or minus $10) $23,475 (plus or minus 510) $16.500 (pus or minus 510) $17,575 pus or minus $10) None of the above is within $10 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts