Question: Moving to another question will save this response. Question 1 of 35 > >> Question 1 6 points Save Answer Suppose that all investors have

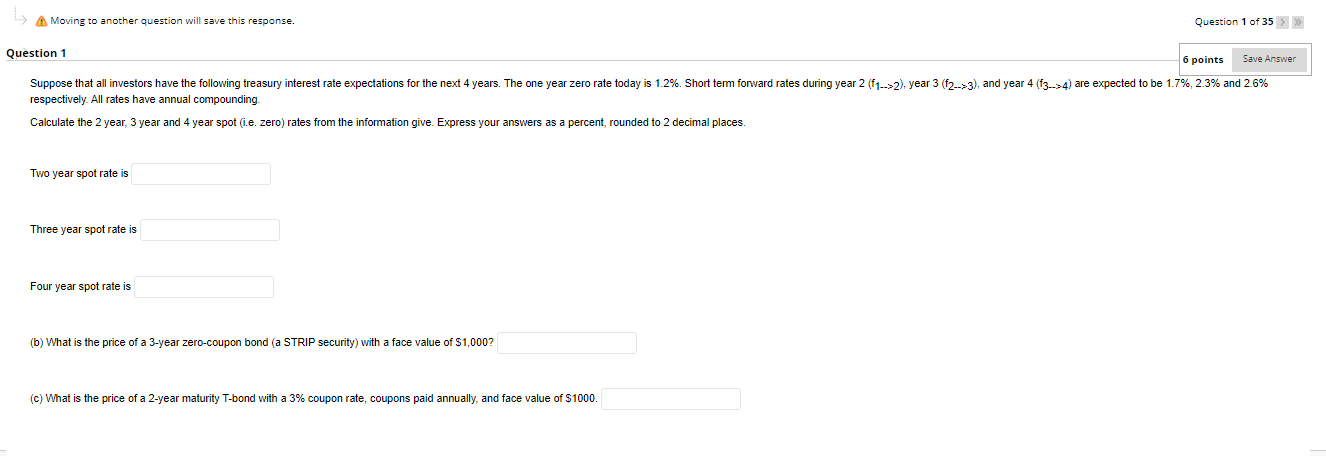

Moving to another question will save this response. Question 1 of 35 > >> Question 1 6 points Save Answer Suppose that all investors have the following treasury interest rate expectations for the next 4 years. The one year zero rate today is 1.2%. Short term forward rates during year 2 (f1..>2), year 3 (f2_.>3), and year 4 (f3_.>4) are expected to be 1.7%, 2.3% and 2.6% respectively. All rates have annual compounding. Calculate the 2 year, 3 year and 4 year spot (i.e. zero) rates from the information give. Express your answers as a percent, rounded to 2 decimal places. Two year spot rate is Three year spot rate is Four year spot rate is (b) What is the price of a 3-year zero-coupon bond (a STRIP security) with a face value of $1,000? (c) What is the price of a 2-year maturity T-bond with a 3% coupon rate, coupons paid annually, and face value of $1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts