Question: Moving to another question will save this response. Question 1 of 2 > >> Question 1 9 points Save Answer Champion Inc., has expected earnings

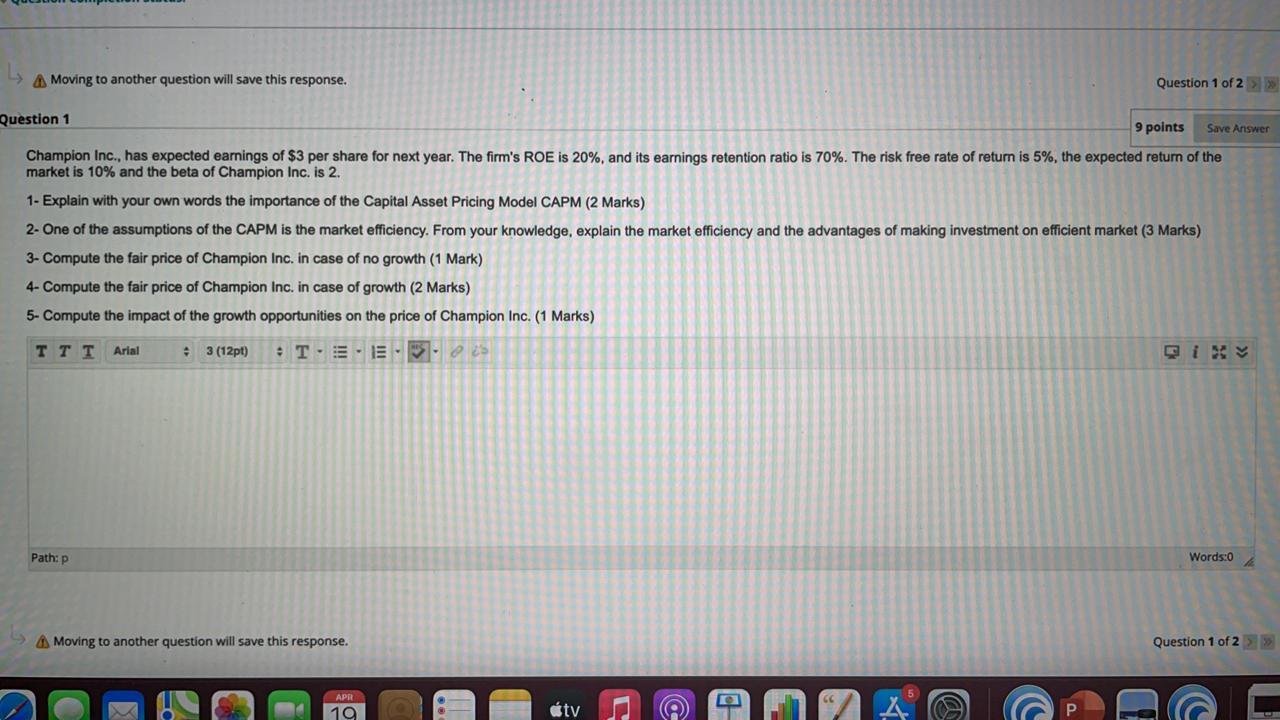

Moving to another question will save this response. Question 1 of 2 > >> Question 1 9 points Save Answer Champion Inc., has expected earnings of $3 per share for next year. The firm's ROE is 20%, and its earnings retention ratio is 70%. The risk free rate of return is 5%, the expected return of the market is 10% and the beta of Champion Inc. is 2. 1- Explain with your own words the importance of the Capital Asset Pricing Model CAPM (2 Marks) 2- One of the assumptions of the CAPM is the market efficiency. From your knowledge, explain the market efficiency and the advantages of making investment on efficient market (3 Marks) 3- Compute the fair price of Champion Inc. in case of no growth (1 Mark) 4- Compute the fair price of Champion Inc. in case of growth (2 Marks) 5- Compute the impact of the growth opportunities on the price of Champion Inc. (1 Marks) TTT Arial 3 (12pt) T.-E.. Path: P Words:0 Moving to another question will save this response. Question 1 of 2 > >> APR 19 tv Moving to another question will save this response. Question 1 of 2 > >> Question 1 9 points Save Answer Champion Inc., has expected earnings of $3 per share for next year. The firm's ROE is 20%, and its earnings retention ratio is 70%. The risk free rate of return is 5%, the expected return of the market is 10% and the beta of Champion Inc. is 2. 1- Explain with your own words the importance of the Capital Asset Pricing Model CAPM (2 Marks) 2- One of the assumptions of the CAPM is the market efficiency. From your knowledge, explain the market efficiency and the advantages of making investment on efficient market (3 Marks) 3- Compute the fair price of Champion Inc. in case of no growth (1 Mark) 4- Compute the fair price of Champion Inc. in case of growth (2 Marks) 5- Compute the impact of the growth opportunities on the price of Champion Inc. (1 Marks) TTT Arial 3 (12pt) T.-E.. Path: P Words:0 Moving to another question will save this response. Question 1 of 2 > >> APR 19 tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts