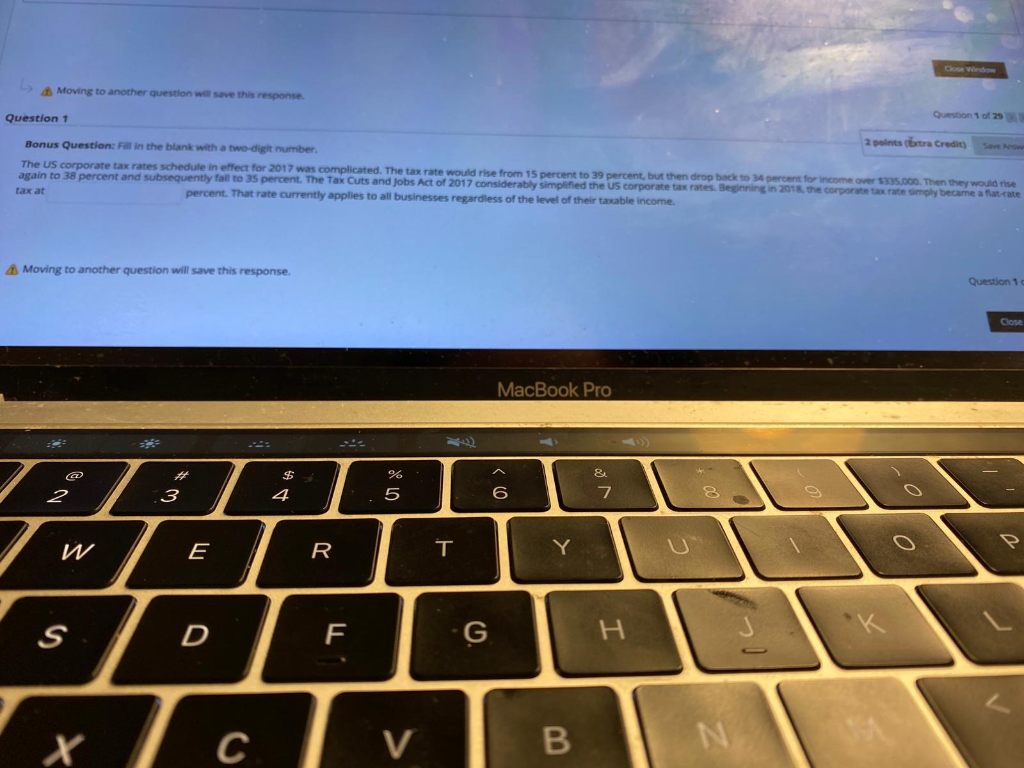

Question: Moving to another question will save this response Question 1 of 29 Question 1 2 points (tra Credit Bonus Question: Fill in the blank with

Moving to another question will save this response Question 1 of 29 Question 1 2 points (tra Credit Bonus Question: Fill in the blank with a two-digit number The US corporate tax rates schedule in effect for 2017 was complicated. The tax rate would rise from 15 percent to 39 percent, but then drop back to 4 percent for income over $335.000. Then they would rise again to 38 percent and subsequently fall to 35 percent. The Tax Cuts and Jobs Act of 2017 considerably simplified the US corporate tax rates. Beginning in 2018, the corporate tax rate simply became a flat-rate tax at percent. That rate currently applies to all businesses regardless of the level of their taxable income. Moving to another question will save this response. Question 1 Close MacBook Pro $ & % 5 3 2 6 E R T Y S D F G H 1 B N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts