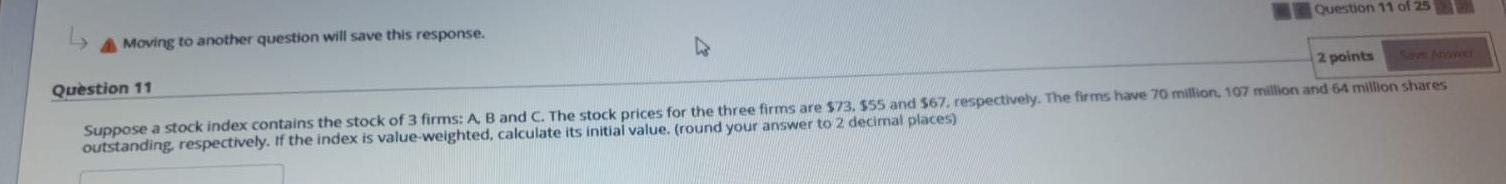

Question: Moving to another question will save this response. Question 11 of 25 Question 11 2 points Suppose a stock index contains the stock of 3

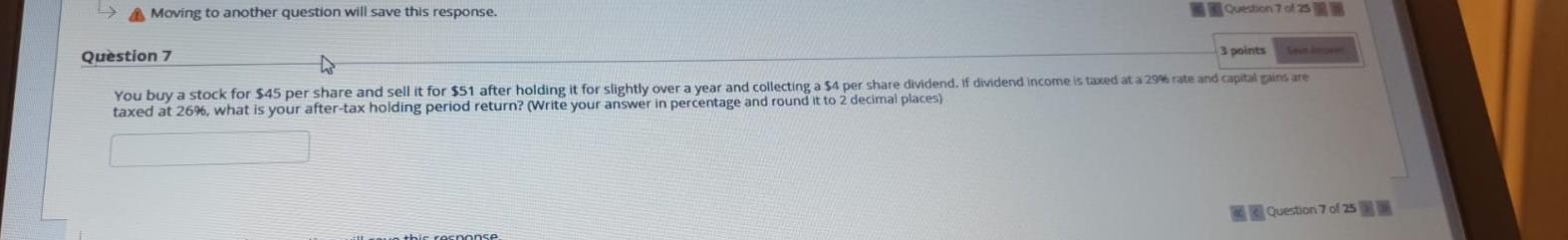

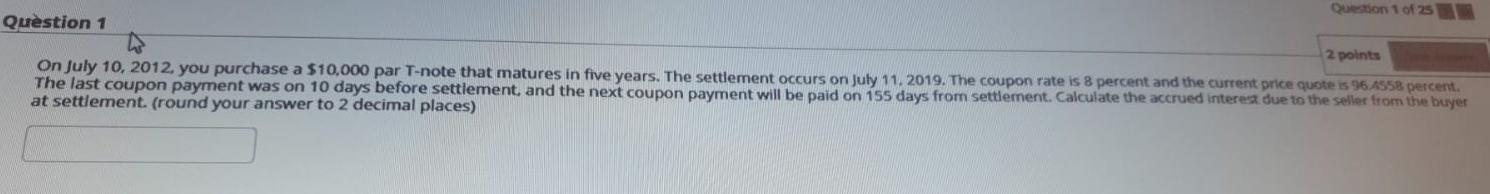

Moving to another question will save this response. Question 11 of 25 Question 11 2 points Suppose a stock index contains the stock of 3 firms: A, B and C. The stock prices for the three firms are $73. 555 and 567. respectively. The firms have 70 million 107 million and 64 million shares outstanding, respectively. If the index is value-weighted, calculate its initial value. (round your answer to 2 decimal places) Moving to another question will save this response. Question 70 Question 7 3 points You buy a stock for $45 per share and sell it for $51 after holding it for slightly over a year and collecting a $4 per share dividend. If dividend income is taxed at a 29% rate and capital gains are taxed at 26%, what is your after-tax holding period return? (Write your answer in percentage and round it to 2 decimal places) Question 7 of 253 this resnanse Question 1 of 25 Question 1 2 points On July 10, 2012. you purchase a $10,000 par T-note that matures in five years. The settlement occurs on July 11.2019. The coupon rate is 8 percent and the current price quote is 96.4558 percent. The last coupon payment was on 10 days before settlement, and the next coupon payment will be paid on 1ss days from settlement. Calculate the accrued interest due to the seller from the buyer at settlement. (round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts