Question: > Moving to another question will save this response. Question 11 of 16 gestion 11 7 points ABC Company manufactures and sells software packages to

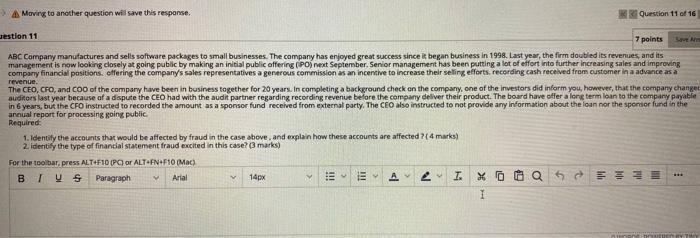

> Moving to another question will save this response. Question 11 of 16 gestion 11 7 points ABC Company manufactures and sells software packages to small businesses. The company has enjoyed great success since began business in 1998. Last year, the firm doubled its revenues, and its management is now looking closely at going public by making an initial public offering (IPO) next September. Senior management has been putting a lot of effort into further increasing sales and improving company financial positions offering the company's sales representatives a generous commission as an incentive to increase their selling efforts recording cash received from customer in advance as a revenue The CEO, CFO, and COO of the company have been in business together for 20 years. In completing a background check on the company, one of the investors did inform you, however, that the company change auditors last year because of a dispute the CEO had with the audit partner regarding recording revenue before the company deliver their product. The board have offer a long term loan to the company puyatlie in 6 years, but the CFO instructed to recorded the amount as a sponsor fund received from external party, The CEO also instructed to not provide any information about the loan nor the sponsor fund in the annual report for processing going public Required 1. Identify the accounts that would be affected by fraud in the case above, and explain how these accounts are affected? [4 marks) 2. identify the type of financial statement fraud excited in this case? (marks) For the toolbar.press ALT+F10 PG or ALTEN. 10 (Mac) BIUS Paragraph Arial 14px A. 2 I. XO O QE 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts