Question: > Moving to another question will save this response. Question 25 A company uses the percent of sales method to determine its bad debts expense.

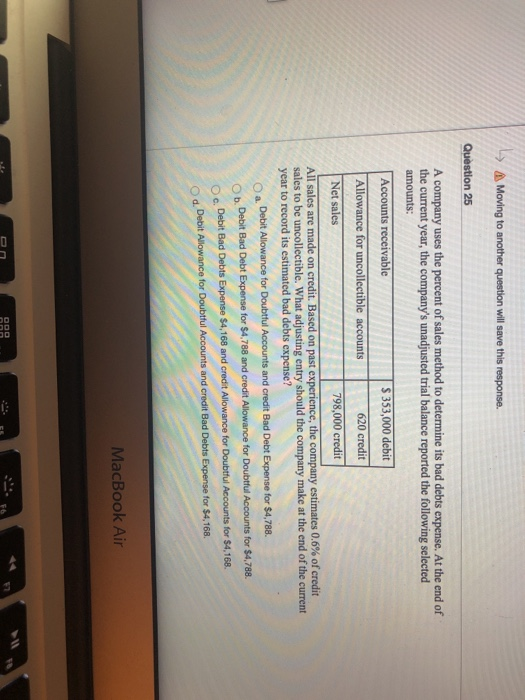

> Moving to another question will save this response. Question 25 A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts: Accounts receivable $ 353,000 debit Allowance for uncollectible accounts 620 credit Net sales 798,000 credit All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? Debit Allowance for Doubtful Accounts and credit Bad Debt Expense for $4,788. Debit Bad Debt Expense for $4,788 and credit Allowance for Doubtful Accounts for $4,788. Ob . Debit Bad Debts Expense $4,168 and credit Allowance for Doubtful Accounts for $4.168. Debit Allowance for Doubtful Accounts and credit Bad Debts Expense for $4,168. a od MacBook Air 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts