Question: Moving to another question will save this response. Question 12 1 points Question 17 A Southern California based firm is forced to choose between Mexico

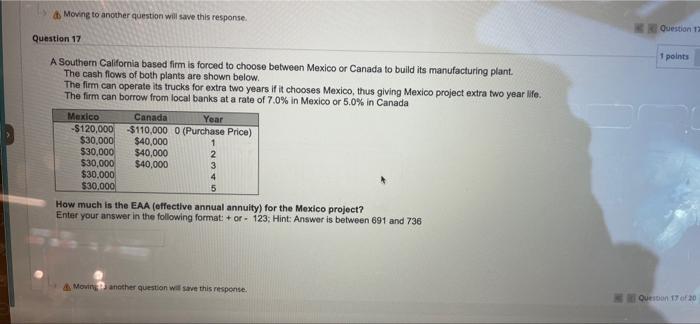

Moving to another question will save this response. Question 12 1 points Question 17 A Southern California based firm is forced to choose between Mexico or Canada to build its manufacturing plant. The cash flows of both plants are shown below. The firm can operate its trucks for extra two years if it chooses Mexico, thus giving Mexico project extra two year life. The firm can borrow from local banks at a rate of 7.0% in Mexico or 5.0% in Canada Mexico Canada Year -$120,000 $110,000 O (Purchase Price) $30,000 $40,000 $30,000 $40,000 2 $30,000 $40,000 3 $30.000 4 $30,000 5 How much is the EAA (effective annual annulty) for the Mexico project? Enter your answer in the following format: + or - 123: Hint: Answer is between 691 and 736 1 Moving another question will save this response. Question of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts