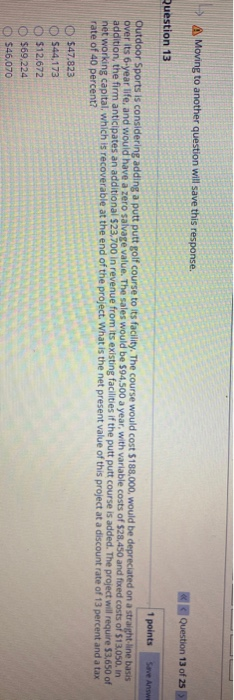

Question: Moving to another question will save this response. Question 13 of 25 Question 13 1 points Save Answe Outdoor Sports is considering adding a putt

Moving to another question will save this response. Question 13 of 25 Question 13 1 points Save Answe Outdoor Sports is considering adding a putt putt golf course to its facility. The course would cost $189.000, would be depreciated on a straight line basis over its 6-year life, and would have a zero salvage value. The sales would be $94.500 a year, with variable costs of $28,450 and foxed costs of $13.050. In addition, the firm anticipates an additional $23.700 in revenue from its existing facilities if the putt putt course is added. The project will require 53,650 of net working capital, which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 13 percent and a tax rate of 40 percent? 0547.823 $44,173 $12.672 $69.224 $46,070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts