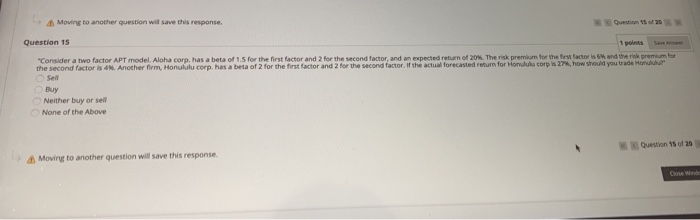

Question: Moving to another question will save this response Question 15 1 points Consider a two factor APT model. Aloha corp, has a beta of 1.5

Moving to another question will save this response Question 15 1 points "Consider a two factor APT model. Aloha corp, has a beta of 1.5 for the first factor and 2 for the second factor, and an expected return of 20%. The risk premium for the festacions and the premium for the second factor is 4. Another firm, Honululu corp. has a beta of 2 for the first factor and 2 for the second factor. If the actual forecasted return for Horvalul corp is 27, how should you trade Honduras Sell Buy Neither buy or sell None of the Above Question 15 of 20 Moving to another question will save this response C We

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts