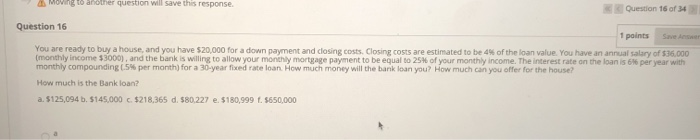

Question: Moving to another question will save this response. Question 16 of 34 Question 16 1 points Save You are ready to buy a house, and

Moving to another question will save this response. Question 16 of 34 Question 16 1 points Save You are ready to buy a house, and you have $20,000 for a down payment and closing costs. Closing costs are estimated to be 4 of the loan value. You have an annual salary of $36.000 (monthly income $3000), and the bank is willing to allow your monthly mortgage payment to be equal to 25% of your monthly income. The interest rate on the loan is 66 per year with monthly compounding (.5% per month) for a 30-year fixed rate loan. How much money will the bank loan you? How much can you offer for the house? How much is the Bank loan? a. $125,094 b. $145,000 $218,365 d. 580.227 e $180,999 1.5650,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts