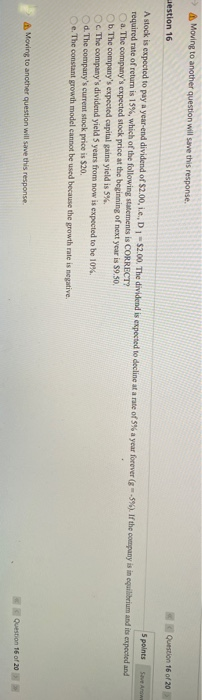

Question: > Moving to another question will save this response. Question 16 of 20 estion 16 5 points over A stock is expected to pay a

> Moving to another question will save this response. Question 16 of 20 estion 16 5 points over A stock is expected to pay a year-end dividend of $2.00, 1.0, D1 - $2.00. The dividend is expected to decline at a rate of 5% a year forever (.5%). If the company is in equilibrium and its expected and required rate of return is 15%, which of the following statements is CORRECT? a. The company's expected stock price at the beginning of next year is $9.50 b. The company's expected capital gains yield is 5% The company's dividend yield 5 years from now is expected to be 10% d. The company's current stock price is $20. e. The constant growth model cannot be used because the growth rate is negative. Moving to another question will save this response Question 16 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts