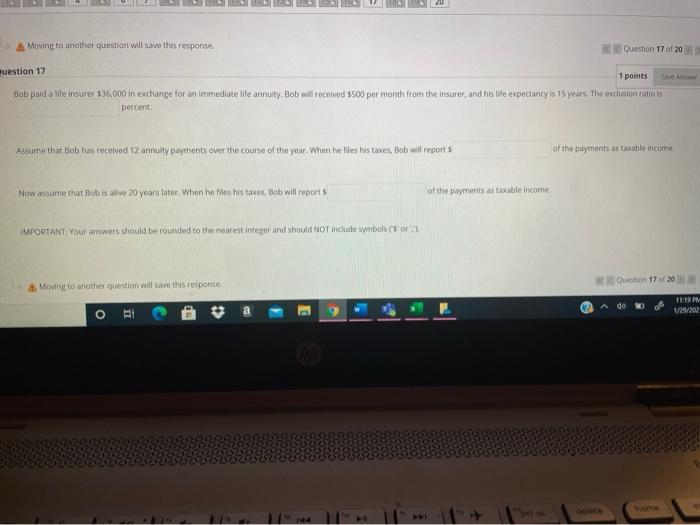

Question: Moving to another question will save this response Question 17 of 203 ve uestion 17 1 points Bob paid a life insures 536.000 in exchange

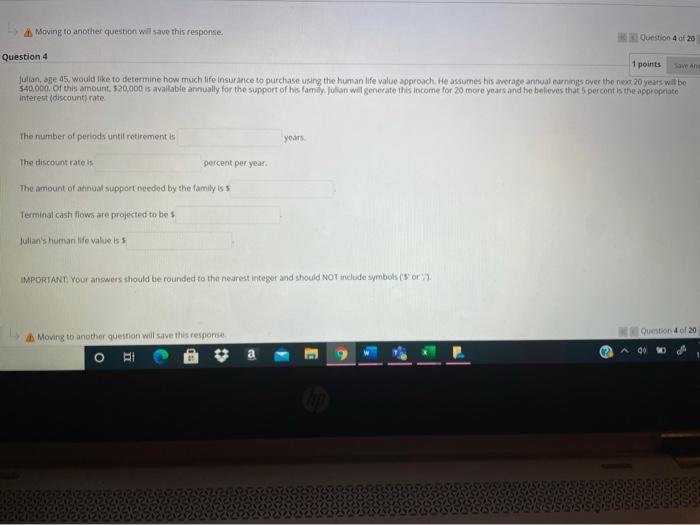

Moving to another question will save this response Question 17 of 203 ve uestion 17 1 points Bob paid a life insures 536.000 in exchange for an immediate life annuity, Bob will received $500 per month from the insurer, and his life expectancy is 15 years. The exclusion ratio percent Assume that Bob has received 12 annuity payments over the course of the year. When he files his taxes, Bob will reports of the payments as taxable income Now assume that Bob is alive 20 years later. When he files his taxes, Bob will reports of the payments as taxable income IMPORTANT: Your answers should be rounded to the nearest Integer and should NOT include symbols (sor Question 17 of 20 Moving to another question will save this response LF 22 11:19 PM 1/29/2002 BI O Moving to another question will save this response Question 4 of 20 Question 4 1 points Julian, age 45, would like to determine how much life insurance to purchase using the human life value approach. He assumes his average annual earnings over the next 20 years will be $40,000, of this amount 520,000 is available annually for the support of his family.Joian wil generate this income for 20 more years and he believes that percent is the appropriate interest (discount rate The number of periods until retirement les years The discount rate is percent per year The amount of annual support needed by the family is Terminal cash flows are projected to be s Julian's human lide valis IMPORTANT Your answers should be rounded to the nearest Integer and should NOT include symbols (or Question of 20 Moving to another question will save this response 2 A O a RI Moving to another question will save this response Question 17 of 203 ve uestion 17 1 points Bob paid a life insures 536.000 in exchange for an immediate life annuity, Bob will received $500 per month from the insurer, and his life expectancy is 15 years. The exclusion ratio percent Assume that Bob has received 12 annuity payments over the course of the year. When he files his taxes, Bob will reports of the payments as taxable income Now assume that Bob is alive 20 years later. When he files his taxes, Bob will reports of the payments as taxable income IMPORTANT: Your answers should be rounded to the nearest Integer and should NOT include symbols (sor Question 17 of 20 Moving to another question will save this response LF 22 11:19 PM 1/29/2002 BI O Moving to another question will save this response Question 4 of 20 Question 4 1 points Julian, age 45, would like to determine how much life insurance to purchase using the human life value approach. He assumes his average annual earnings over the next 20 years will be $40,000, of this amount 520,000 is available annually for the support of his family.Joian wil generate this income for 20 more years and he believes that percent is the appropriate interest (discount rate The number of periods until retirement les years The discount rate is percent per year The amount of annual support needed by the family is Terminal cash flows are projected to be s Julian's human lide valis IMPORTANT Your answers should be rounded to the nearest Integer and should NOT include symbols (or Question of 20 Moving to another question will save this response 2 A O a RI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts