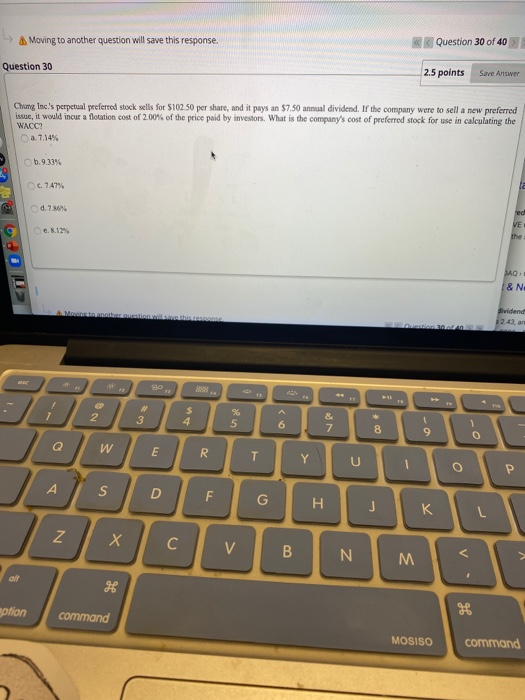

Question: -> Moving to another question will save this response. Question 30 of 40 Question 30 2.5 points Save Answer Chang Inc.'s perpetual preferred stock sells

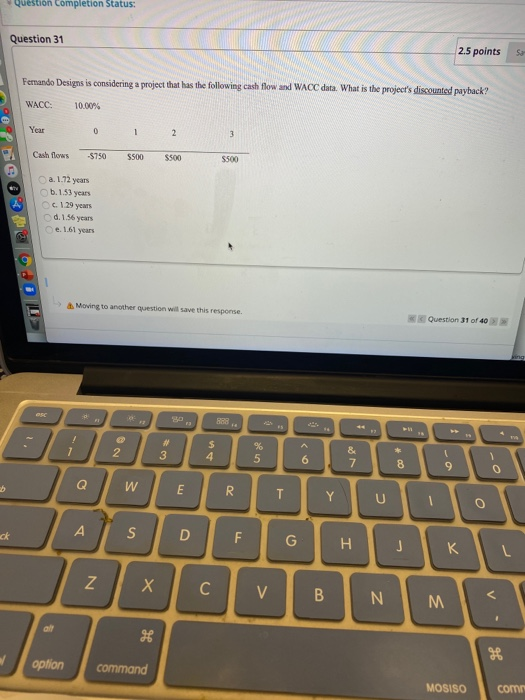

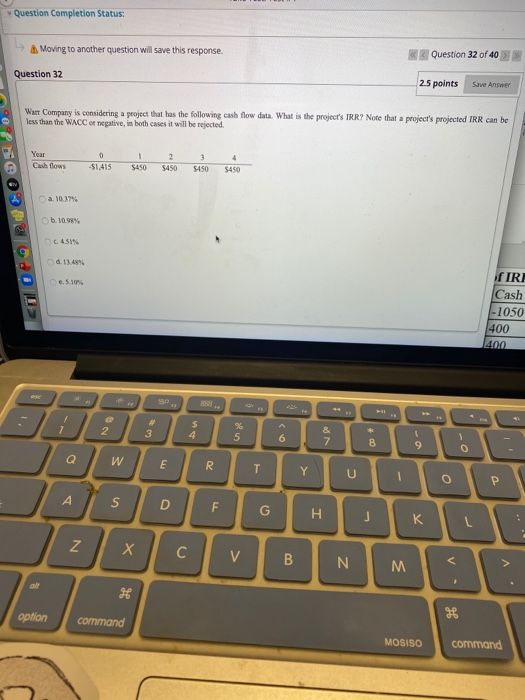

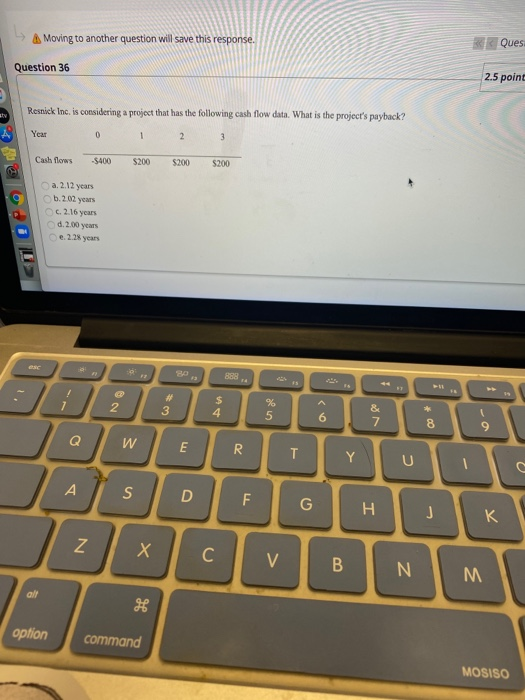

-> Moving to another question will save this response. Question 30 of 40 Question 30 2.5 points Save Answer Chang Inc.'s perpetual preferred stock sells for $102.50 per share, and it pays an $7.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 2.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? Ca. 7.14% 6.9.33% c. 7.47% 0.7.6% e. 8.129 JAD & NO vidend 1243. an J12438 Ja w ERU TOP ption command MOSISO command Question Completion Status: Question 31 Question 31 2.5 points 25 points s so Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.00% Year Cash flows $750 $500 $500 @ @ a. 1.72 years 6.1.53 years c. 129 years d. 1.56 years e. 1.61 years bi Moving to another question will save this response Question 31 of 40 option command MOSISO come Question Completion Status: > Moving to another question will save this response. Question 32 of 40 Question 32 2.5 points Save Answer War Company is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. Cashflows 51,415 $450 $450 $450 $450 O a. 10.37% 6.10.98% 11 @ODOU IRI Cash -1050 400 : 8 ; option command MOSISO command - A Moving to another question will save this response. Ques Question 36 2.5 point Resnick Inc. is considering a project that has the following cash flow data. What is the project's payback? Year Cash flows $400 $200 $200 $200 a.2.12 years 6.2.02 years c.2.16 years d. 2.00 years c.2.28 years JADUGOOR option command MOSISO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts