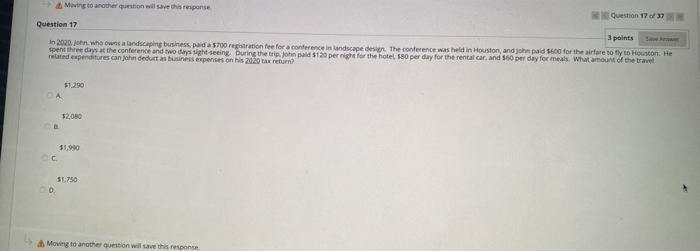

Question: Moving to another question will save this response Question 1737 Question 17 3 points In 2020. john who owns a landscaping business paid a 5700

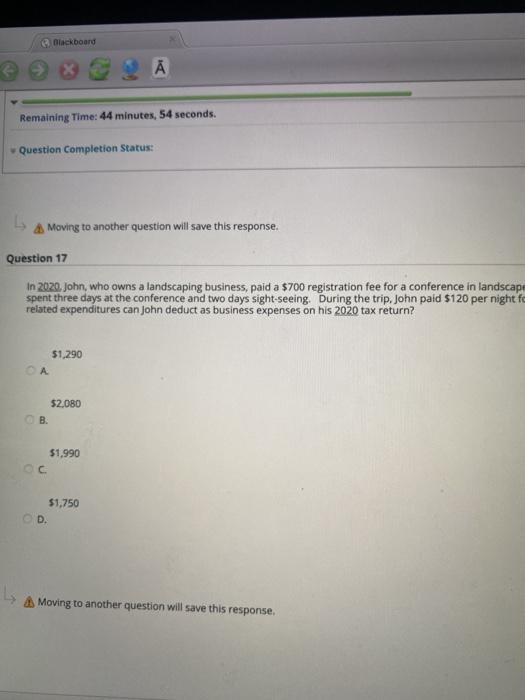

Moving to another question will save this response Question 1737 Question 17 3 points In 2020. john who owns a landscaping business paid a 5700 registration fee for a conference in landscape design. The conference was held in Houston and John paid for the airfare to fly to Houston. He spent three days the conference and two days sightseeing During the trip. John Bad 5120 per night for the hotel 580 per day for the rental car, and 160 per day for meals. What amount of the travel related expenditures can john deductas business expenses on his 2020 tax return 510290 $2,000 51.90 31.750 Moving to another question will save this response Blackboard Remaining Time: 44 minutes, 54 seconds. Question Completion Status: A Moving to another question will save this response. Question 17 in 2020. John, who owns a landscaping business, paid a $700 registration fee for a conference in landscape spent three days at the conference and two days sight-seeing. During the trip. John paid $120 per night fe related expenditures can John deduct as business expenses on his 2020 tax return? $1,290 OA $2,080 . $1.990 $1,750 D. Moving to another question will save this response. Question 17 of 37 3 points Save Answ registration fee for a conference in landscape design. The conference was held in Houston, and John paid $600 for the airfare to fly to Houston. He During the trip. John paid $120 per night for the hotel, $80 per day for the rental car, and $60 per day for meals. What amount of the travel his 2020 tax return? Question 17 of 37 Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts