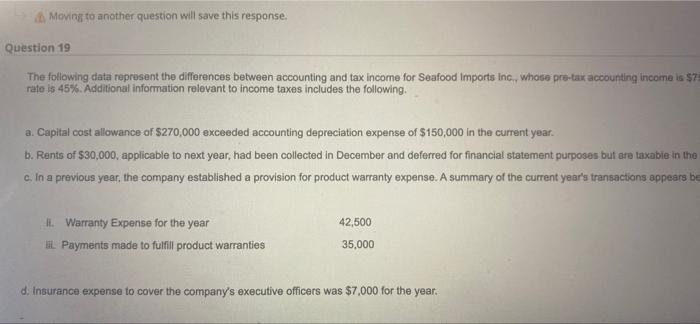

Question: Moving to another question will save this response. Question 19 The following data represent the differences between accounting and tax income for Seafood Imports Inc,

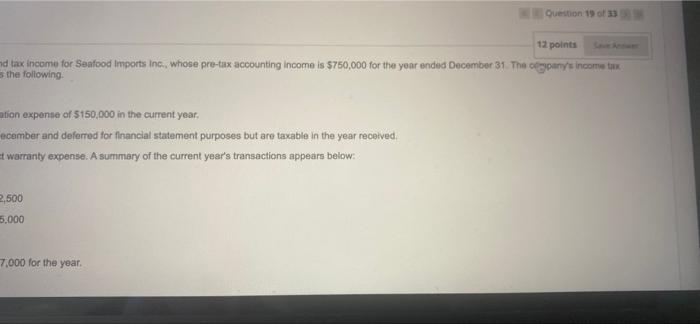

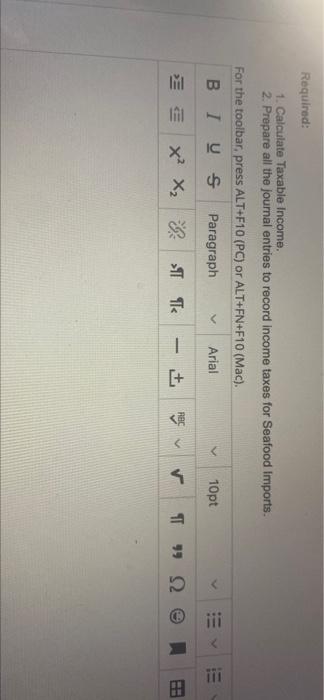

Moving to another question will save this response. Question 19 The following data represent the differences between accounting and tax income for Seafood Imports Inc, whose pro-tax accounting income is $7? rate is 45%. Additional information relevant to income taxes includes the following a. Capital cost allowance of $270,000 exceeded accounting depreciation expense of $150,000 in the current year. b. Rents of $30,000, applicable to next year, had been collected in December and deferred for financial statement purposes but are taxable in the c. In a previous year, the company established a provision for product warranty expense. A summary of the current year's transactions appears be 42,500 Warranty Expense for the year lil Payments made to fulfill product warranties 35,000 d. Insurance expense to cover the company's executive officers was $7,000 for the year. Question 19 33 12 points nd tax income for Seafood Imports Inc, whose pre-tax accounting income is $750,000 for the year ended December 31 The organy income tax the following mtion expense of 5150,000 in the current year, ecember and deferred for financial statement purposes but are taxable in the year received # warranty expense. A summary of the current year's transactions appears below: 2,500 5.000 7.000 for the year Required: 1. Calculate Taxable income. 2. Prepare all the journal entries to record income taxes for Seafood Imports. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial V 10pt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts