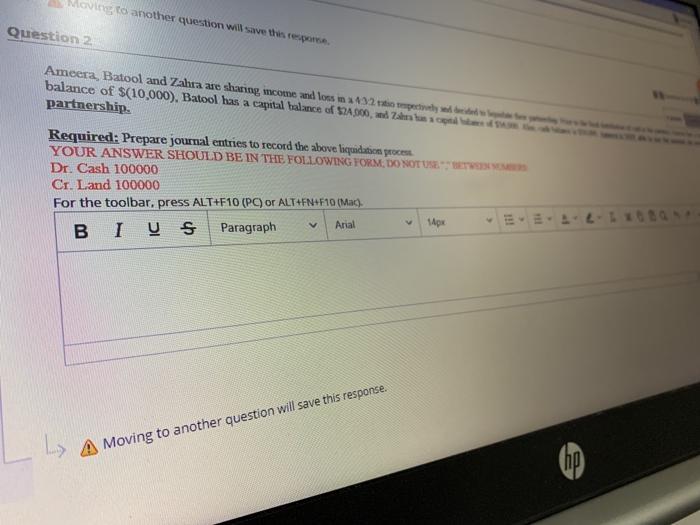

Question: Moving to another question will save this response Question 2 Ameera Batool and Zahra are sharing, mcome and lots in 432 balance of $(10,000). Batool

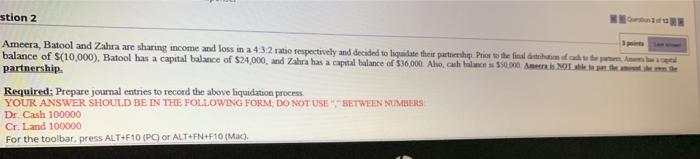

Moving to another question will save this response Question 2 Ameera Batool and Zahra are sharing, mcome and lots in 432 balance of $(10,000). Batool has a capital balance of $2A300, Zakop partnership. Required: Prepare journal entries to record the above liquidation procen. YOUR ANSWER SHOULD BE IN THE FOLLOWING TORM, DO NOT USE TW Dr. Cash 100000 Cr. Land 100000 For the toolbar, press ALT+F10 (PC) or ALT+FN+F 10 (Mac). 1px Arial Paragraph V BI U S Moving to another question will save this response. mp stion 2 Ameera, Batool and Zahra are sharing income and loss in a 4 3 2 ratio respectively and decided to liquidate their partarship Prior to the final de la balance of S(10,000). Batool has a capital balance of $24.000, and Zahra has a capital balance of 536,000. Alio, cah bales 550.000 ANO partnership Required: Prepare journal entries to record the above liquidation process YOUR ANSWER SHOULD BE IN THE FOLLOWING FORM, DO NOT USE BETWEEN NUMBERS Dr Cash 100000 Cr. Land 100000 For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts