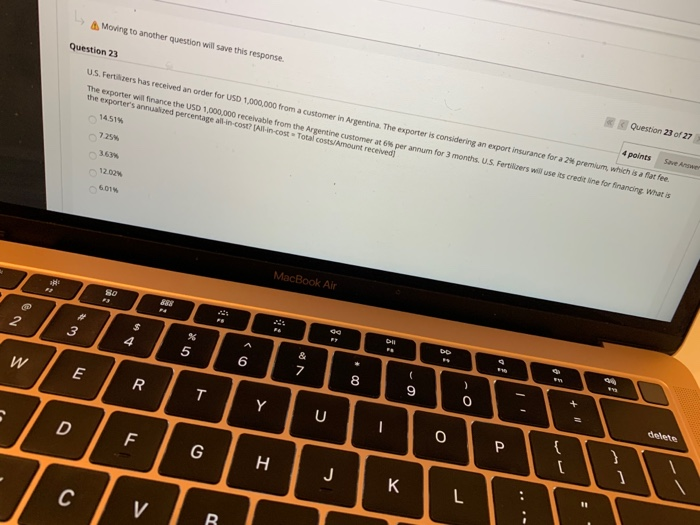

Question: Moving to another question will save this response. Question 23 4 points US. Fertilizers has received an order for USD 1,000,000 from a customer in

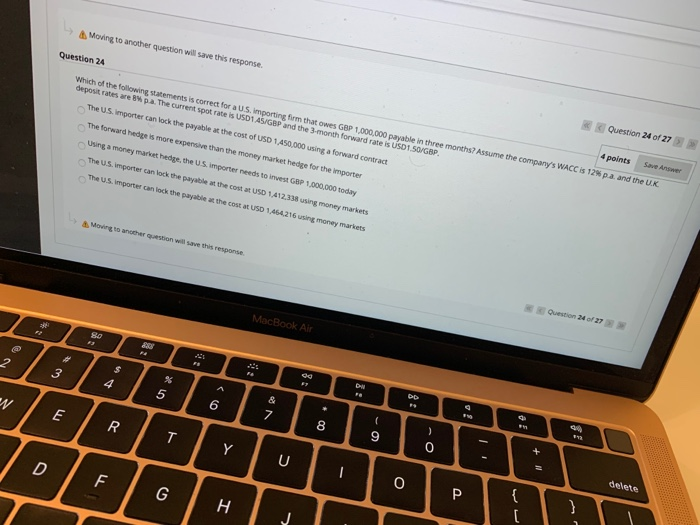

Moving to another question will save this response. Question 23 4 points US. Fertilizers has received an order for USD 1,000,000 from a customer in Argentina. The exporter is considering an export insurance for a 2 premium, which is a flat fee. The exporter wil finance the USD 1,000,000 receivable from the Argentine customer at 6% per annum for 3 months. US. Fertilizers will use its credit line for financing what is the exporter's annualized percentage all-in cost? All-in-cost-Total costs/Amount received 14.51% Question 23 of 27 7254 12.02 6.01 MacBook Air . 0 888 2 3 $ 4 FY % 5 W 6 & 7 E R 8 T 9 Y 0 + U - D delete O F G H { I J K C L V R Moving to another question will save this response Question 24 4 points Save Answer Which of the following statements is correct for a U.S. importing firm that owes GBP 1,000,000 payable in three months? Assume the company's WACC is 12% pa, and the UK deposit rates are pa. The current spot rate is USD145/GBP and the 3-month forward rate is USD 150/GBP The US. Importer can lock the payable at the cost of USD 1,450,000 using a forward contract The forward hedge is more expensive than the money market hedge for the importer Using a money market hedge, the US importer needs to invest GBP 1.000.000 today The US importer can lock the payable at the cost at USD 1412.338 using money markets The U.S.Importer can lock the payable at the cost at USD 1464216 using money markets Question 24 of 27 Moving to another stion will save this response Question 24/27 MacBook Air So 2 FE 3 $ 4 % 5 DW W 6 E 7 . R 8 T 9 ) 0 Y D U W + 1 F O delete G {

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts