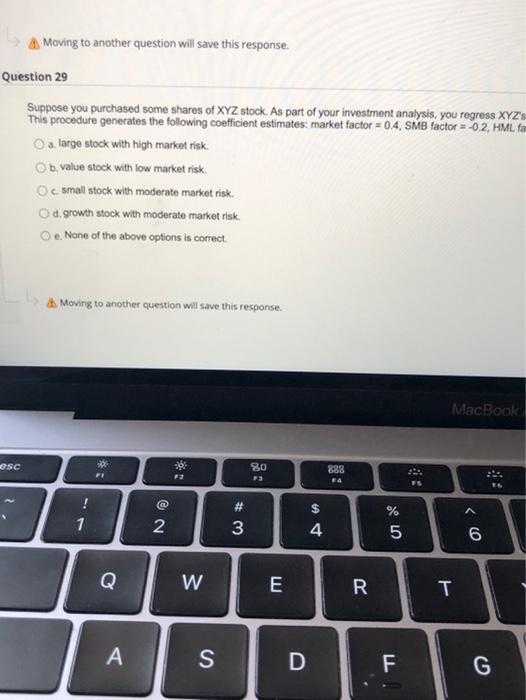

Question: Moving to another question will save this response. Question 29 Suppose you purchased some shares of XYZ stock. As part of your investment analysis, you

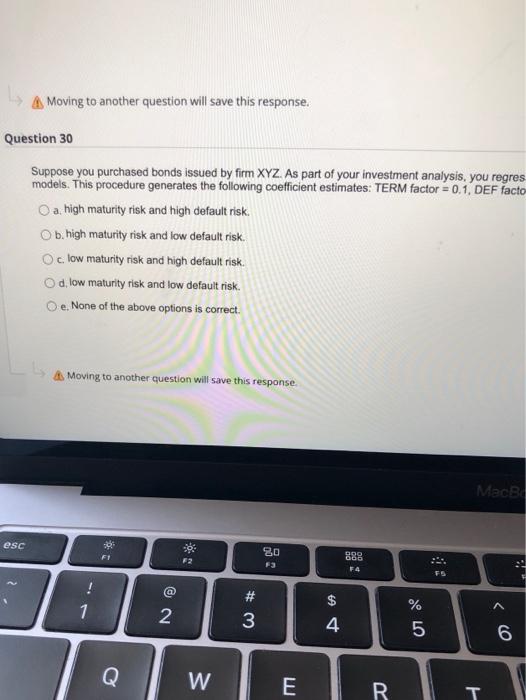

Moving to another question will save this response. Question 29 Suppose you purchased some shares of XYZ stock. As part of your investment analysis, you regress XYZ'S This procedure generates the following coefficient estimates: market factor = 04, SMB factor = -0.2, HML fam O a large stock with high market risk. Ob, value stock with low market risk. Oc small stock with moderate market risk. Od growth stock with moderate market risk. Oe None of the above options is correct Moving to another question will save this response. MacBook ESC 80 888 16 # $ A 1 2 3 4 ? 6 Q W E R T S D F F G Close Window Question 29 of 33 3.03 points Save Answer ou regress XYZ monthly returns for the past five years against the three factors specified in the Fama and French models. Etor 02, HML factor = 12. You conclude that XY2 is most likely to be a Question 29 of 33 Close Window MacBook Air . do DI DO A P 10 am 517 ( ) 6 & 7 8 TI 9 O Y U I O P. { [ } 1 I K L A Moving to another question will save this response. Question 30 Suppose you purchased bonds issued by firm XYZ. As part of your investment analysis, you regres models. This procedure generates the following coefficient estimates: TERM factor = 0.1, DEF facto O a high maturity risk and high default risk. O b. high maturity risk and low default risk. c. low maturity risk and high default risk. Od low maturity risk and low default risk. Oe. None of the above options is correct. Moving to another question will save this response. MacB esc 80 F2 F3 888 F4 1 1 N # 3 A $ 4 % 5 6 Q W E R T Close Wind Question 30 of 33 Save An 3.03 points gress ita monthly returns for the past five years against the five factors specified in the Fama and French bond pricing factor = 02. You conclude that this bond is most likely to have Question 30 of 33 Close Window MacBook Air oo PI DD 790 00) 12 1 5 & 7 > O 8 9 N + Y U I } O P { [ 1 H J L Moving to another question will save this response. Question 29 Suppose you purchased some shares of XYZ stock. As part of your investment analysis, you regress XYZ'S This procedure generates the following coefficient estimates: market factor = 04, SMB factor = -0.2, HML fam O a large stock with high market risk. Ob, value stock with low market risk. Oc small stock with moderate market risk. Od growth stock with moderate market risk. Oe None of the above options is correct Moving to another question will save this response. MacBook ESC 80 888 16 # $ A 1 2 3 4 ? 6 Q W E R T S D F F G Close Window Question 29 of 33 3.03 points Save Answer ou regress XYZ monthly returns for the past five years against the three factors specified in the Fama and French models. Etor 02, HML factor = 12. You conclude that XY2 is most likely to be a Question 29 of 33 Close Window MacBook Air . do DI DO A P 10 am 517 ( ) 6 & 7 8 TI 9 O Y U I O P. { [ } 1 I K L A Moving to another question will save this response. Question 30 Suppose you purchased bonds issued by firm XYZ. As part of your investment analysis, you regres models. This procedure generates the following coefficient estimates: TERM factor = 0.1, DEF facto O a high maturity risk and high default risk. O b. high maturity risk and low default risk. c. low maturity risk and high default risk. Od low maturity risk and low default risk. Oe. None of the above options is correct. Moving to another question will save this response. MacB esc 80 F2 F3 888 F4 1 1 N # 3 A $ 4 % 5 6 Q W E R T Close Wind Question 30 of 33 Save An 3.03 points gress ita monthly returns for the past five years against the five factors specified in the Fama and French bond pricing factor = 02. You conclude that this bond is most likely to have Question 30 of 33 Close Window MacBook Air oo PI DD 790 00) 12 1 5 & 7 > O 8 9 N + Y U I } O P { [ 1 H J L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts