Question: Moving to another question will save this response. Question 3 of 51 Question 3 10 points Saved Note: This is an optional problem Solve this

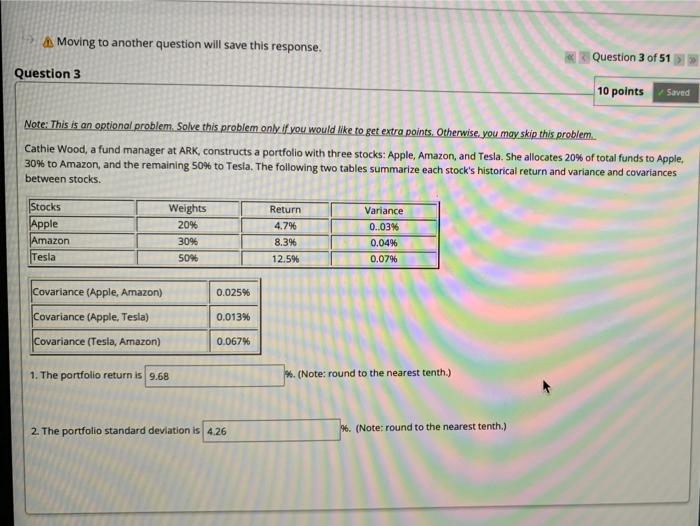

Moving to another question will save this response. Question 3 of 51 Question 3 10 points Saved Note: This is an optional problem Solve this problem only if you would like to get extra points. Otherwise, you may skip this problem Cathie Wood, a fund manager at ARK, constructs a portfolio with three stocks: Apple, Amazon, and Tesla. She allocates 20% of total funds to Apple, 30% to Amazon, and the remaining 50% to Tesia. The following two tables summarize each stock's historical return and variance and covariances between stocks. Stocks Apple Amazon Tesla Weights 20% 3096 50% Return 4.796 8.3% 12.5% Variance 0..03% 0.04% 0.07% Covariance (Apple, Amazon) 0.025% 0.013% Covariance (Apple, Tesla) Covariance (Tesla, Amazon) 0.067% 1. The portfolio return is 9.68 6. (Note: round to the nearest tenth.) 2. The portfolio standard deviation is 4.26 46. (Note: round to the nearest tenth.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts