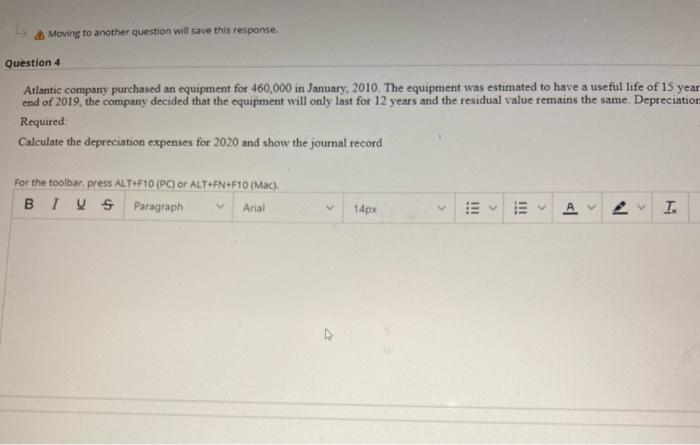

Question: Moving to another question will save this response Question 4 Atlantic company purchased an equipment for 460,000 in January, 2010. The equipment was estimated to

Moving to another question will save this response Question 4 Atlantic company purchased an equipment for 460,000 in January, 2010. The equipment was estimated to have a useful life of 15 year end of 2019, the company decided that the equipment will only last for 12 years and the residual value remains the same. Depreciation Required Calculate the depreciation expenses for 2020 and show the journal record For the toolbar, press ALT+F10 (PC) or ALT=FN+F10 (Mac) BI V & Paragraph Arial 14px ili 11! > A T. 5 points ary, 2010. The equipment was estimated to have a useful life of 15 years with a residual value of 10,000. At the - last for 12 years and the residual value remains the same. Depreciation is calculated on a straight-line basis. Save Answer anal record > 14px !!! A v In t to 2 Q se O WORDS POWERED BY TINY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts