Question: Moving to another question will save this response. Question 5 of 7 Question 5 6 points Save Answer A company has a call option written

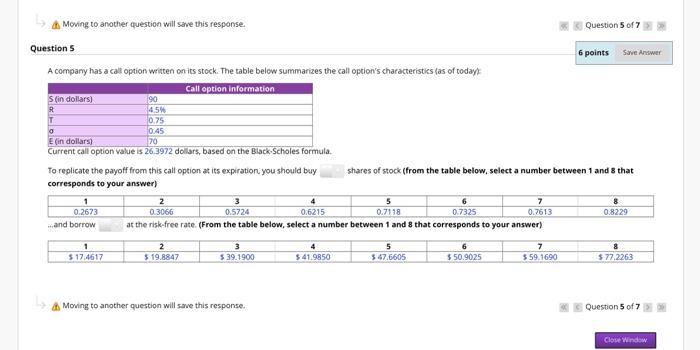

Moving to another question will save this response. Question 5 of 7 Question 5 6 points Save Answer A company has a call option written on its stock. The table below summarizes the call option's characteristics (as of today Call option information Sin dollars) 90 4.5 0.75 o 0.45 Ein dollars) 70 Current call option value is 26.3972 dollars, based on the Black Scholes formula To replicate the payoff from this call option at its expiration, you should buy shares of stock (from the table below, select a number between 1 and 8 that corresponds to your answer) 2 3 6 7 0.2673 0.3066 0.5724 0.6215 0.7118 0.7325 0.7613 0.8229 and borrow at the risk-free rate (From the table below, select a number between 1 and 8 that corresponds to your answer) 1 $17.4617 2 $19.8847 $39.1900 5 5 47.6605 7 $59.1690 $41.9850 $50.9025 $77.2263 Moving to another question will save this response. Question 5 of 7 Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts