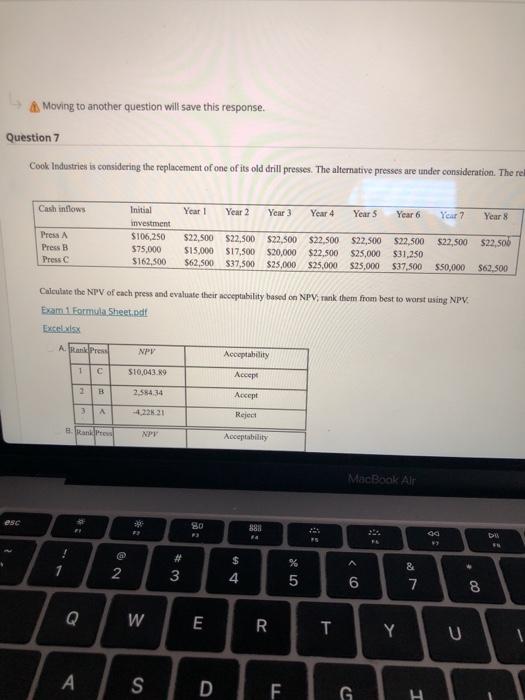

Question: Moving to another question will save this response. Question 7 Cook Industries is considering the replacement of one of its old drill presses. The alternative

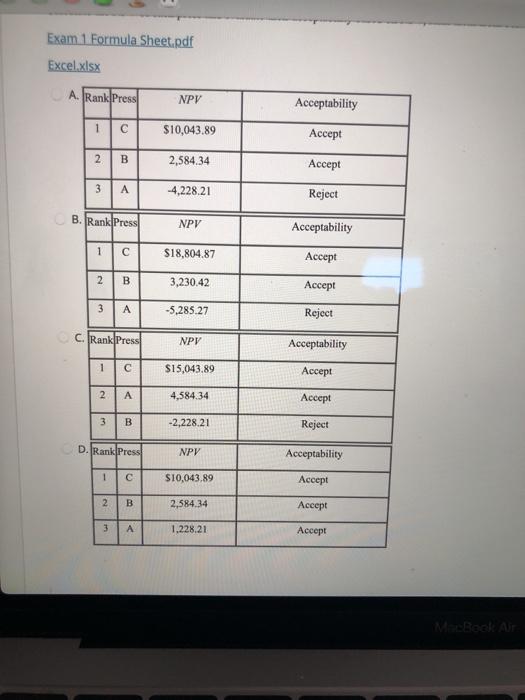

Moving to another question will save this response. Question 7 Cook Industries is considering the replacement of one of its old drill presses. The alternative presses are under consideration. The re Cash inflows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year Year Press A Press B Press C Initial investment $106,250 $75,000 $162,500 $22,500 $22,500 $22,500 $22,500 $15.000 $17.500 $62,500 $37,500 $22.500 $22,500 $22,500 $22,500 $20,000 $22,500 $25,000 $31.250 $25,000 $25,000 $25,000 $37.500 $50,000 $62.500 Calculate the NPV of each press and evaluate their acceptability based on NPV, rank them from best to worst using NPV: Exam 1 Formula Sheet.pdf A Rand Press NPV Acceptability 1 S10,043.89 Accept 2 B 2.584.34 Accept 3 Reject Rani Per NPT Acceptability MacBook Air esc 80 881 Du 58 @ # % 1 2 3 $ 4 5 6 & 7 8 W E R T Y . S D F G H Exam 1 Formula Sheet.pdf Excel.xlsx A. Rank Press NPV Acceptability 1 $10,043.89 Accept 2 B 2,584.34 Accept 3 -4,228.21 Reject B. Rank Press NPV Acceptability 1 $18,804.87 Accept 2 B 3,230.42 Accept 3 A -5,285,27 Reject c. Rank Press NPV Acceptability 1 $15,043.89 Accept 2 4,584.34 Accept A B -2,228.21 Reject D. Rank Press NPV Acceptability 1 $10,043.89 Accept 2 B 2,584.34 Accept 3 1.228.21 Accept Rock Ar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts