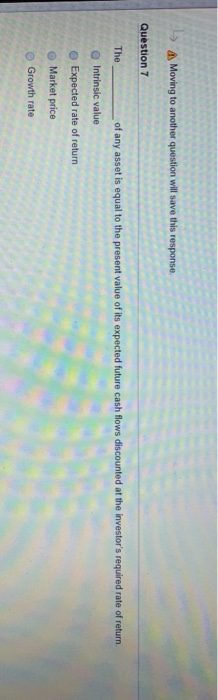

Question: -> Moving to another question will save this response. Question 7 The of any asset is equal to the present value of its expected future

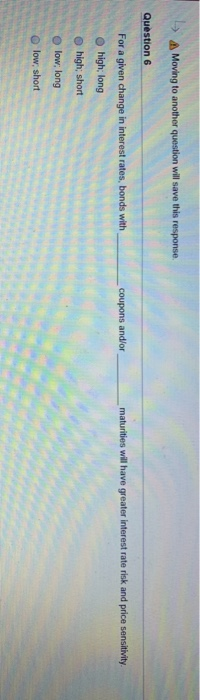

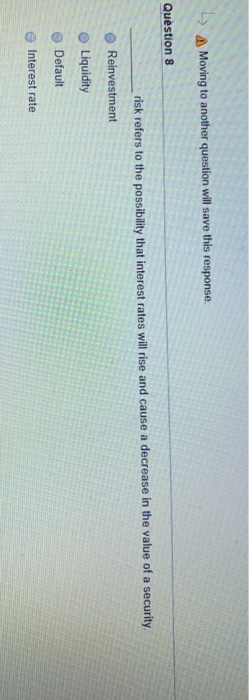

-> Moving to another question will save this response. Question 7 The of any asset is equal to the present value of its expected future cash flows discounted at the investor's required rate of return Intrinsic value Expected rate of return Marne Market price O Growth rate -> Moving to another question will save this response Question 6 coupons and/or maturities will have greater interest rate risk and price sensitivity For a given change in interest rates, bonds with high; long high short low, long low, long low, short L) Moving to another question will save this response. Question 8 risk refers to the possibility that interest rates will rise and cause a decrease in the value of a security Reinvestment Liquidity Default Interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts