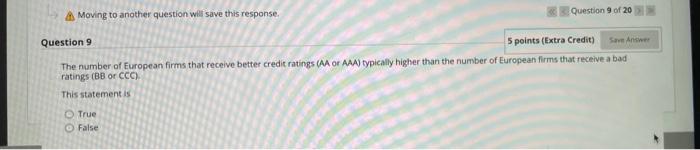

Question: Moving to another question will save this response. Question 9 of 2011 Question 9 5 points (Extra Credit) Save Answer The number of European firms

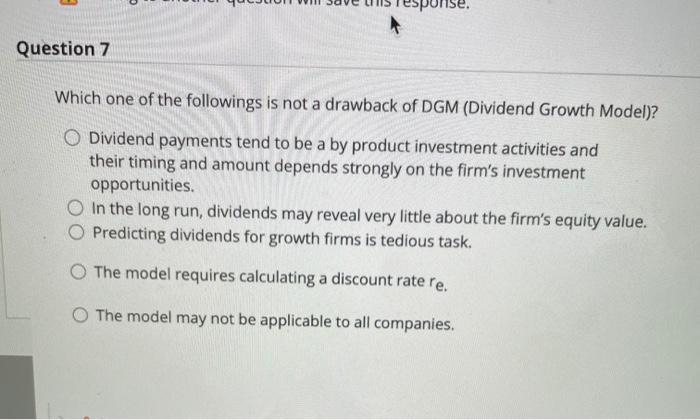

Moving to another question will save this response. Question 9 of 2011 Question 9 5 points (Extra Credit) Save Answer The number of European firms that receive better credit ratings (AA or AAA typically higher than the number of European firms that receive a bad ratings (BB or CCC) This statement is True False onse. Question 7 Which one of the followings is not a drawback of DGM (Dividend Growth Model)? O Dividend payments tend to be a by product investment activities and their timing and amount depends strongly on the firm's investment opportunities. In the long run, dividends may reveal very little about the firm's equity value. O Predicting dividends for growth firms is tedious task. The model requires calculating a discount rate re. The model may not be applicable to all companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts