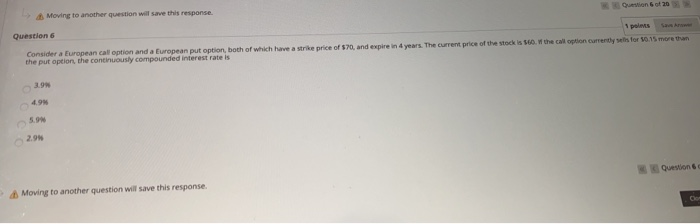

Question: Moving to another question will save this response. Question of 20 Question 6 spoles Consider a European call option and a European put option, both

Moving to another question will save this response. Question of 20 Question 6 spoles Consider a European call option and a European put option, both of which have a strike price of 570, and expire in 4 years. The current price of the stock is the call option currently sets for 50.15 more than the put option, the continuously compounded interest rate is 2.99 4.9 2.91 Questions Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock