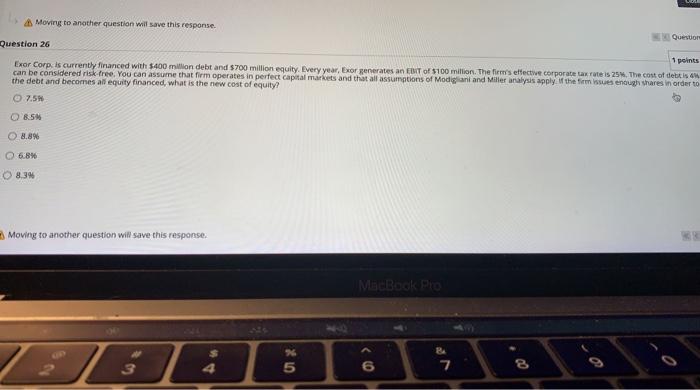

Question: Moving to another question will save this response. Questo Question 26 1 points Exor Corp. is currently financed with $400 million debt and $700 million

Moving to another question will save this response. Questo Question 26 1 points Exor Corp. is currently financed with $400 million debt and $700 million equity. Every year, Exor generates an EBIT of 100 million. The firm's effective corporate tax rate is 25. The cost of debitis en can be considered riskfree. You can assume that firm operates in perfect capital markets and that all assumptions of Modigiani and Miller analysis apply the firm us enough thares in order to the debt and becomes all equity financed, what is the new cost of equity? 7.5 O 8.5 8.8% 68% 8.3% Moving to another question will save this response. MeBook Pro * 5 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts