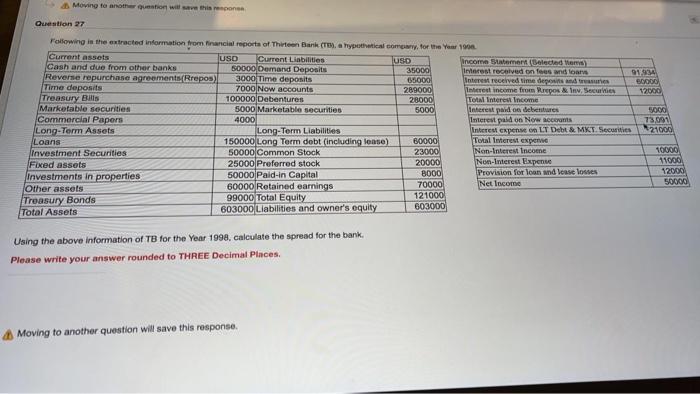

Question: Moving to another question will see this one Question 27 Following is the extracted information from financial reports of Thirteen Bank ( Trypothetical comoww. for

Moving to another question will see this one Question 27 Following is the extracted information from financial reports of Thirteen Bank ( Trypothetical comoww. for the year 1901 Current assets USD Current Liabilities USD Income Sammeldade Cash and due from other banks 50000 Demand Deposits 35000 Interest received ones and loans 9153 Reverse repurchase agreements (Rrepos) 3000 Time deposits 65000 Interest received time depois de tres B000 Time deposits 7000 Now accounts 289000 Interest income from repos & Inw. Securves 12000 Treasury Bills 100000 Dobentures 28000 Total Interest Income Marketable securities 5000 Marketable securities 5000 Interest paid o deres 5000 Commercial Papers 4000 Interest paid on New Rects 73,097 Long-Term Assets Long-Term Liabilities Interest capere LT Debt. MKT Securities 2100 Loans 150000 Long Term dobt (including lense) 10000 Total merest experie Investment Securities 23000 50000 Common Stock 10000 Non-Interest Incone Fixed assets 20000 25000 Preferred stock 11000 Non-Interest Expense B000 12000 50000 Paid-in Capital Provision for loan and lease losses Investments in properties 70000 500700 60000 Retained earnings Net Income Other assets 99000 Total Equity 121000 Treasury Bonds 603000 Total Assets 603000 Liabilities and owner's oquity Using the above information of TB for the Year 1998, calculate the spread for the bank. Please write your answer rounded to THREE Decimal Places Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts