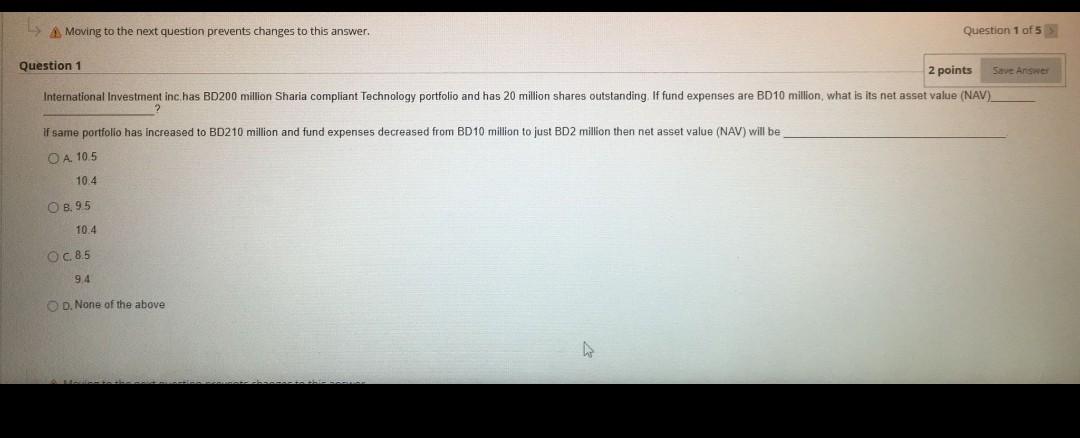

Question: Moving to the next question prevents changes to this answer. Question 1 of 5 Question 1 2 points Save Answer International Investment inchas BD200 million

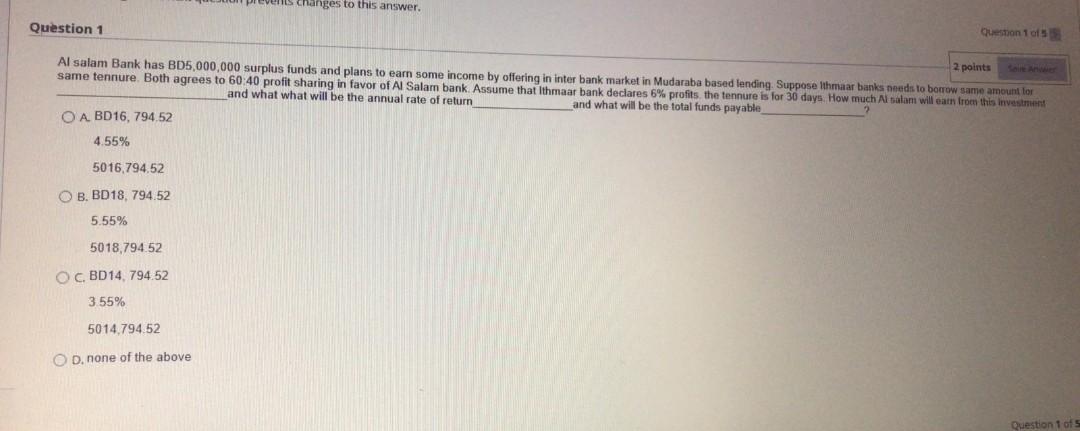

Moving to the next question prevents changes to this answer. Question 1 of 5 Question 1 2 points Save Answer International Investment inchas BD200 million Sharia compliant Technology portfolio and has 20 million shares outstanding. If fund expenses are BD10 million, what is its net asset value (NAV) ? if same portfolio has increased to BD210 million and fund expenses decreased from BD10 million to just BD2 million then net asset value (NAV) will be O A 10.5 10.4 8.95 10.4 OC.8.5 94 D. None of the above changes to this answer. Question 1 Question 1 of 5 2 points Al salam Bank has BD5,000,000 surplus funds and plans to earn some income by offering in inter bank market in Mudaraba based lending Suppose Ithmaar banks needs to borrow same amount for same tennure. Both agrees to 60:40 profit sharing in favor of Al Salam bank. Assume that Ithmaar bank declares 6% profits the tennure is for 30 days. How much Alsalam will earn from this investment and what what will be the annual rate of return and what will be the total funds payable O A BD16,794,52 4.55% 5016.794.52 OB, BD18, 794.52 5.55% 5018,794.52 O CBD14, 794.52 355% 5014,794.52 O D. none of the above Question 1 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts