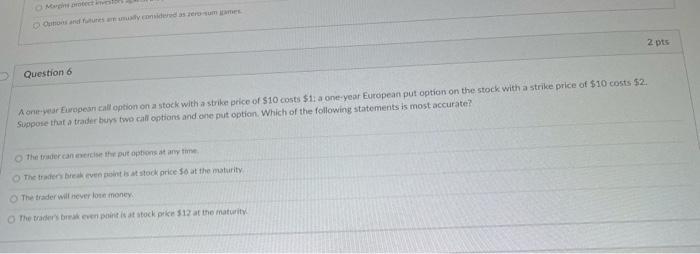

Question: Mpo Oors com serum 2 pts Question 6 A one-year ropean call option on a stock with a strike price of $10 costs $11 a

Mpo Oors com serum 2 pts Question 6 A one-year ropean call option on a stock with a strike price of $10 costs $11 a one-year European put option on the stock with a strike price of $10 costs $2. Suppose that a trader buys two call options and one put option. Which of the following statements is most accurate? The trader cancer put options at any time The traders break even point is a stock prices at the maturity The trader will never lose money. The traders event is a stock pre $12 at the maturity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock