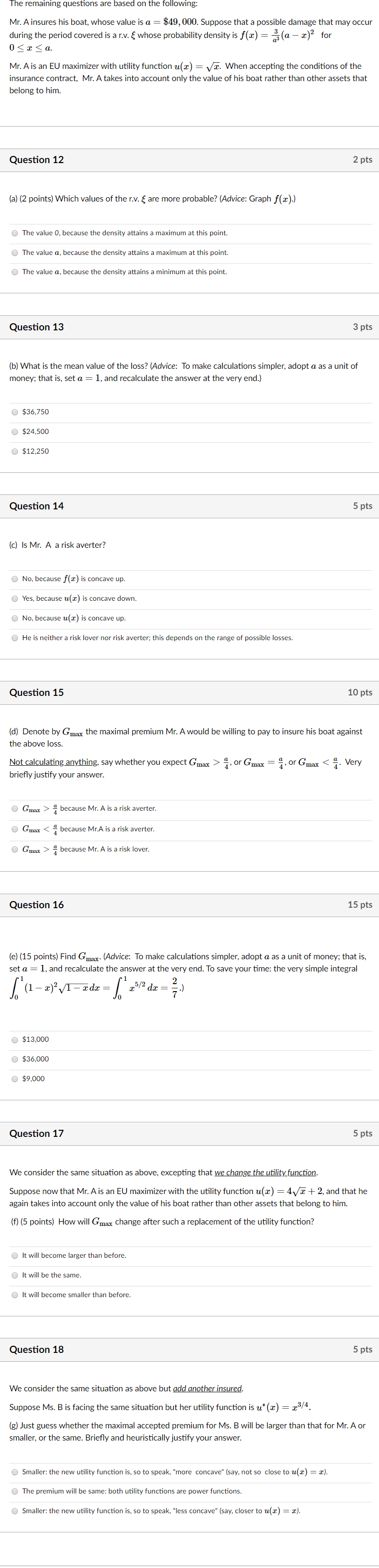

Question: Mr. A insures his boat, whose value is a = $49, 000. Suppose that a possible damage that may occur during the period covered is

Mr. A insures his boat, whose value is a = $49, 000. Suppose that a possible damage that may occur during the period covered is a r.v. & whose probability density is f(x) = (a - x) for 0 q. or Gmax = 4. or Gmax " because Mr. A is a risk averter. . Gmax because Mr. A is a risk lover. Question 16 15 pts (e) (15 points) Find Gmax. (Advice: To make calculations simpler, adopt a as a unit of money; that is, et a = 1, and recalculate the answer at the very end. To save your time: the very simple integral $13,000 $36,000 $9,000 Question 17 5 pts We consider the same situation as above, excepting that we change the utility function. Suppose now that Mr. A is an EU maximizer with the utility function u(x) = 4va + 2, and that he again takes into account only the value of his boat rather than other assets that belong to him. (f) (5 points) How will Gmax change after such a replacement of the utility function? . It will become larger than before. It will be the same. It will become smaller than before. Question 18 5 pts We consider the same situation as above but add another insured. Suppose Ms. B is facing the same situation but her utility function is u* (a) = a3/4. (g) Just guess whether the maximal accepted premium for Ms. B will be larger than that for Mr. A or smaller, or the same. Briefly and heuristically justify your answer. Smaller: the new utility function is, so to speak, "more concave" (say, not so close to u(I) = =). The premium will be same: both utility functions are power functions. Smaller: the new utility function is, so to speak, "less concave" (say, closer to u(I) = )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts