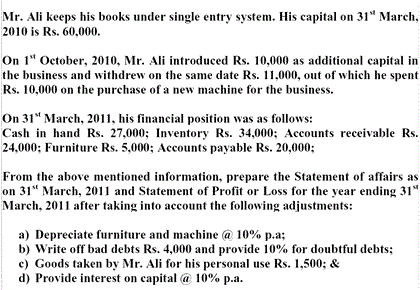

Question: Mr. All keeps his books under single entry system. His capital on 31st March, 2010 is Rs. 60, 000. On 1st October, 2010, Mr. All

Mr. All keeps his books under single entry system. His capital on 31st March, 2010 is Rs. 60, 000. On 1st October, 2010, Mr. All introduced Rs. 10, 000 as additional capital in the business and withdrew on the same date Rs. 11, 000, out of which he spent Rs. 10, 000 on the purchase of a new machine for the business. On 31st March, 2011, his financial position was as follows: Cash in hand Rs. 27, 000; Inventory Rs. 34, 000; Accounts receivable Rs. 24.000; Furniture Rs. 5, 000; Accounts payable Rs. 20.000; From the above mentioned information, prepare the Statement of affairs as on 31st March, 2011 and Statement of Profit or Loss for the year ending 31st March. 2011 after taking into account the following adjustments: Depreciate furniture and machine @ 10% p.a; Write off bad debts Rs. 4.000 and provide 10% for doubtful debts; Goods taken by Mr. Ali for his personal use Rs. 1.500; & Provide interest on capital @ 10% p.a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts