Question: Mr. and Mrs. Keller file a joint return and have taxable income of $410,000 without considering the following independent fact situations. (Click the icon to

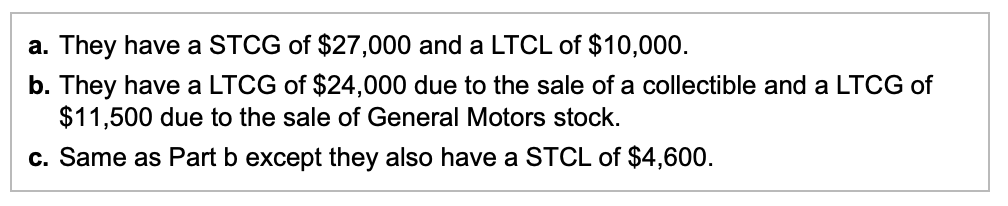

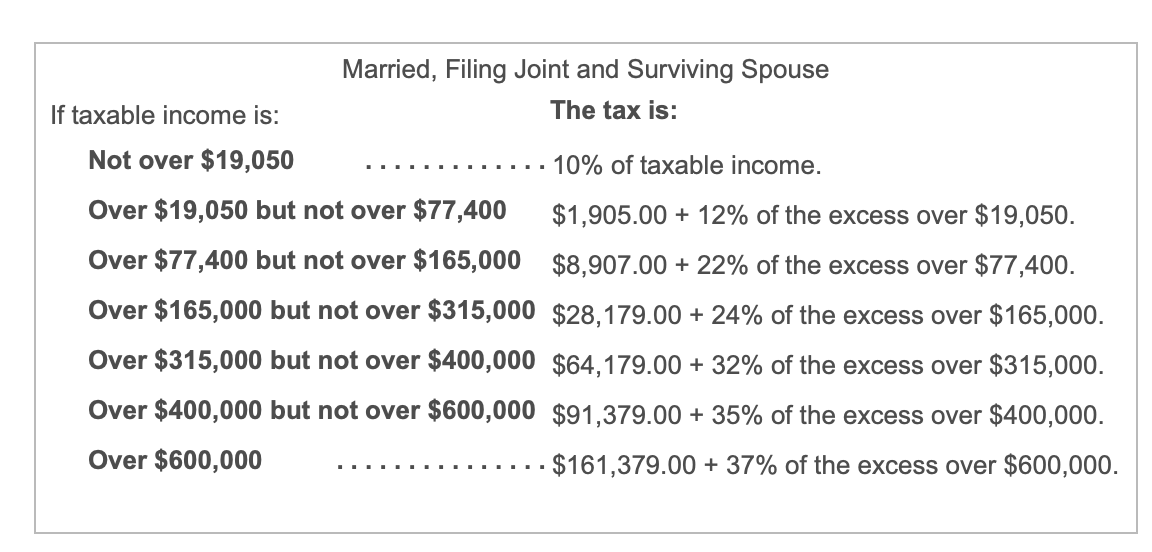

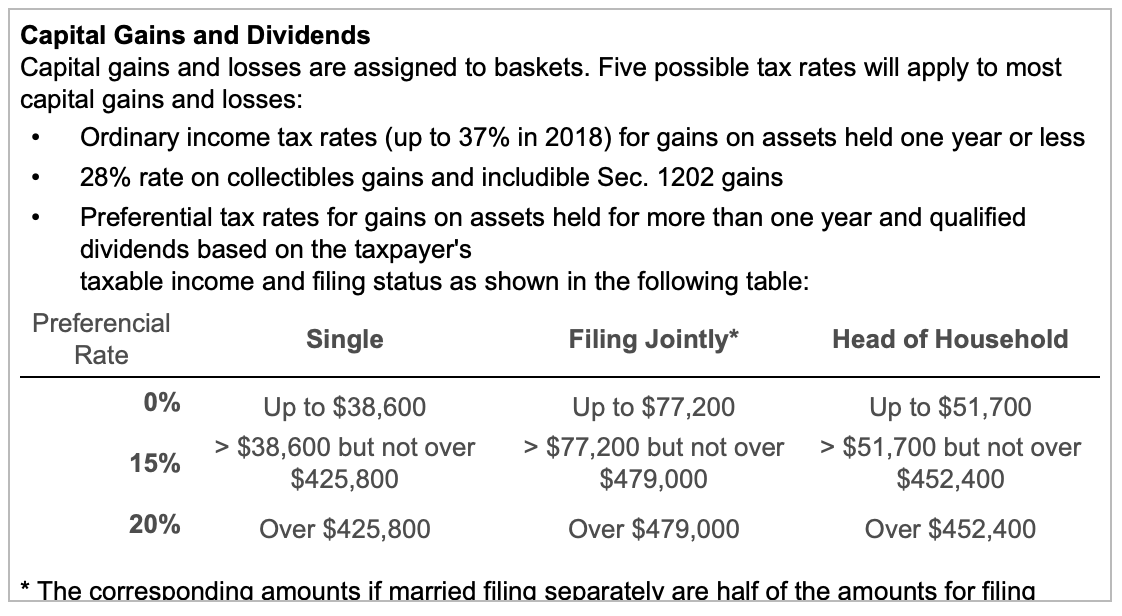

Mr. and Mrs. Keller file a joint return and have taxable income of $410,000 without considering the following independent fact situations. (Click the icon to view the independent fact situations.) (Click the icon to view the 2018 tax rate schedule for the Married, Filing Joint and Surviving Spouse filing status.) 3 (Click the icon to view the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends.) Requirement Determine the increase in their tax liability for each independent fact situation. Situation a. Determine the increase in their tax liability when they have a STCG of $27,000 and a LTCL of $10,000. Increase in tax liability a. They have a STCG of $27,000 and a LTCL of $10,000. b. They have a LTCG of $24,000 due to the sale of a collectible and a LTCG of $11,500 due to the sale of General Motors stock. c. Same as Part b except they also have a STCL of $4,600. Married, Filing Joint and Surviving Spouse If taxable income is: The tax is: Not over $19,050 ............. 10% of taxable income. Over $19,050 but not over $77,400 $1,905.00 + 12% of the excess over $19,050. Over $77,400 but not over $165,000 $8,907.00 + 22% of the excess over $77,400. Over $165,000 but not over $315,000 $28,179.00 + 24% of the excess over $165,000. Over $315,000 but not over $400,000 $64,179.00 + 32% of the excess over $315,000. Over $400,000 but not over $600,000 $91,379.00 + 35% of the excess over $400,000. Over $600,000 .... $161,379.00 + 37% of the excess over $600,000. Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2018) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Single Filing Jointly* Head of Household Rate 0% Up to $38,600 Up to $77,200 Up to $51,700 > $38,600 but not over > $77,200 but not over > $51,700 but not over 15% $425,800 $479,000 $452,400 20% Over $425,800 Over $479,000 Over $452,400 * The corresponding amounts if married filina separately are half of the amounts for filina Mr. and Mrs. Keller file a joint return and have taxable income of $410,000 without considering the following independent fact situations. (Click the icon to view the independent fact situations.) (Click the icon to view the 2018 tax rate schedule for the Married, Filing Joint and Surviving Spouse filing status.) 3 (Click the icon to view the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends.) Requirement Determine the increase in their tax liability for each independent fact situation. Situation a. Determine the increase in their tax liability when they have a STCG of $27,000 and a LTCL of $10,000. Increase in tax liability a. They have a STCG of $27,000 and a LTCL of $10,000. b. They have a LTCG of $24,000 due to the sale of a collectible and a LTCG of $11,500 due to the sale of General Motors stock. c. Same as Part b except they also have a STCL of $4,600. Married, Filing Joint and Surviving Spouse If taxable income is: The tax is: Not over $19,050 ............. 10% of taxable income. Over $19,050 but not over $77,400 $1,905.00 + 12% of the excess over $19,050. Over $77,400 but not over $165,000 $8,907.00 + 22% of the excess over $77,400. Over $165,000 but not over $315,000 $28,179.00 + 24% of the excess over $165,000. Over $315,000 but not over $400,000 $64,179.00 + 32% of the excess over $315,000. Over $400,000 but not over $600,000 $91,379.00 + 35% of the excess over $400,000. Over $600,000 .... $161,379.00 + 37% of the excess over $600,000. Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2018) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Single Filing Jointly* Head of Household Rate 0% Up to $38,600 Up to $77,200 Up to $51,700 > $38,600 but not over > $77,200 but not over > $51,700 but not over 15% $425,800 $479,000 $452,400 20% Over $425,800 Over $479,000 Over $452,400 * The corresponding amounts if married filina separately are half of the amounts for filina

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts