Question: Mr . and Mrs . Poe earned $ 1 1 5 , 9 0 0 compensation income and $ 9 6 3 interest this year

Mr and Mrs Poe earned $ compensation income and $ interest this year and recognized a $ shortterm capital gain

and a $ longterm capital gain on the sale of securities They incurred $ innestment interestentense and $ other

itemized deductions. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends:

Required:

a Compute the Poes' income tax on a joint return if they don't elect to treat longterm capital gain as investment income.

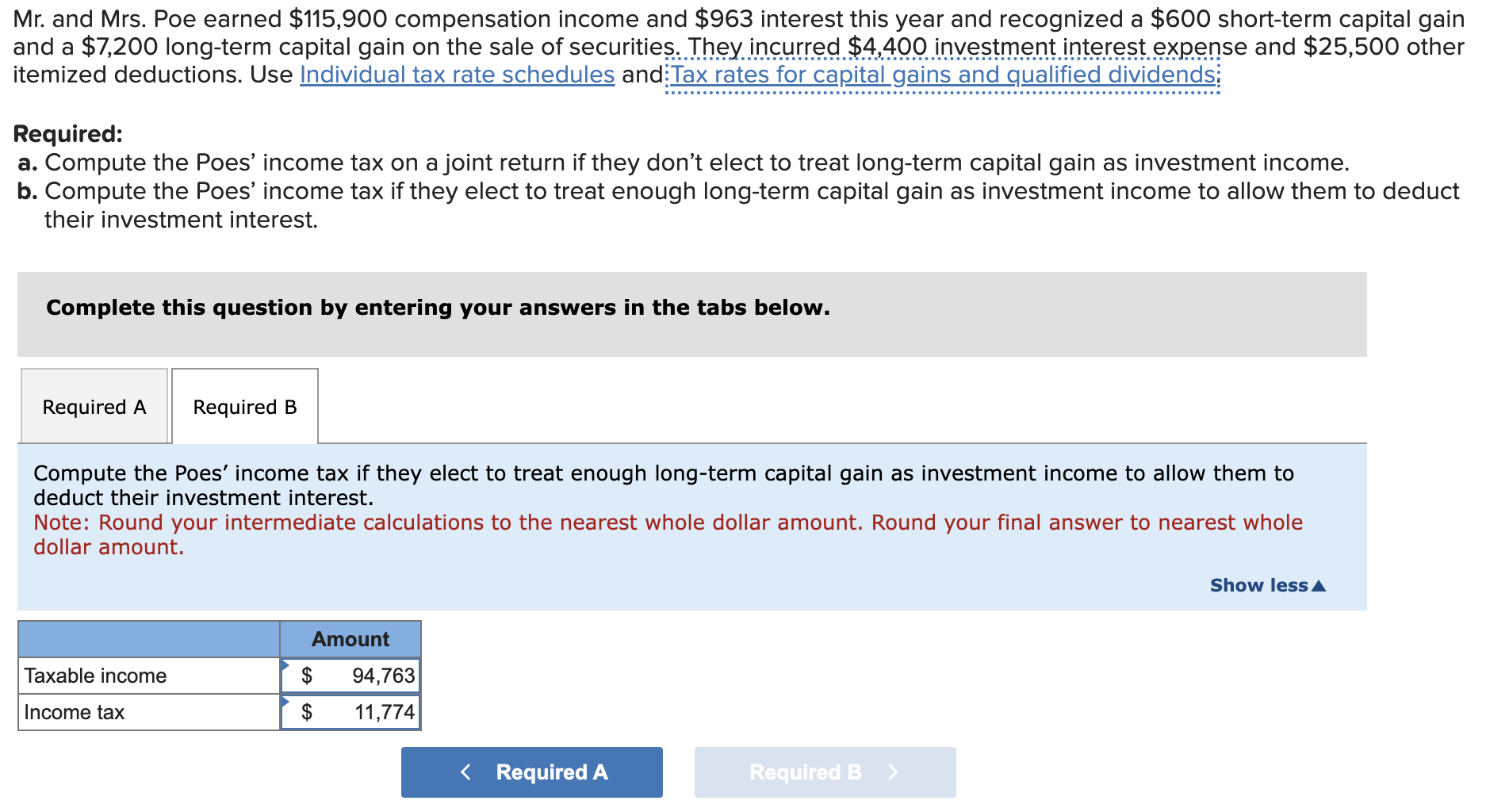

b Compute the Poes' income tax if they elect to treat enough longterm capital gain as investment income to allow them to deduct

their investment interest.

Complete this question by entering your answers in the tabs below.

Required A

Compute the Poes' income tax if they elect to treat enough longterm capital gain as investment income to allow them to

deduct their investment interest.

Note: Round your intermediate calculations to the nearest whole dollar amount. Round your final answer to nearest whole

dollar amount.Mr and Mrs Poe earned $ compensation income and $ interest this year and recognized a $ shortterm capital gain and a $ longterm capital gain on the sale of securities They incurred $ investment interest expense and $ other itemized deductions. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends.

Required:

Compute the Poes income tax on a joint return if they dont elect to treat longterm capital gain as investment income.

Compute the Poes income tax if they elect to treat enough longterm capital gain as investment income to allow them to deduct their investment interest.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock