Question: Mr and Ms Adams files a joint return, and both 67 years old. They have two children, one lives with the bio dad 60%

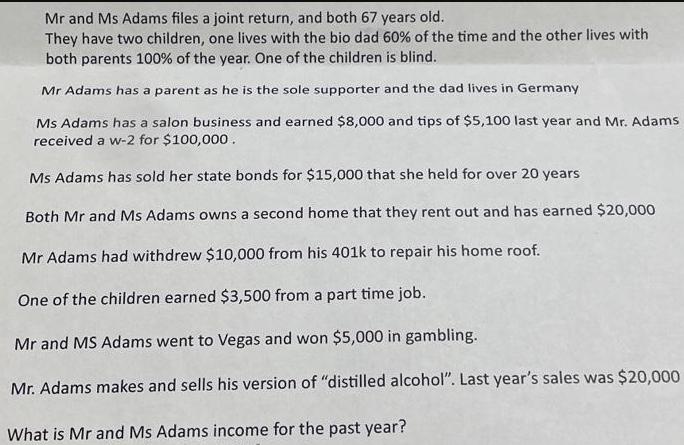

Mr and Ms Adams files a joint return, and both 67 years old. They have two children, one lives with the bio dad 60% of the time and the other lives with both parents 100% of the year. One of the children is blind. Mr Adams has a parent as he is the sole supporter and the dad lives in Germany Ms Adams has a salon business and earned $8,000 and tips of $5,100 last year and Mr. Adams received a w-2 for $100,000. Ms Adams has sold her state bonds for $15,000 that she held for over 20 years Both Mr and Ms Adams owns a second home that they rent out and has earned $20,000 Mr Adams had withdrew $10,000 from his 401k to repair his home roof. One of the children earned $3,500 from a part time job. Mr and MS Adams went to Vegas and won $5,000 in gambling. Mr. Adams makes and sells his version of "distilled alcohol". Last year's sales was $20,000 What is Mr and Ms Adams income for the past year?

Step by Step Solution

There are 3 Steps involved in it

To calculate Mr and Ms Adams income for the past year we need to consider various sources of income ... View full answer

Get step-by-step solutions from verified subject matter experts