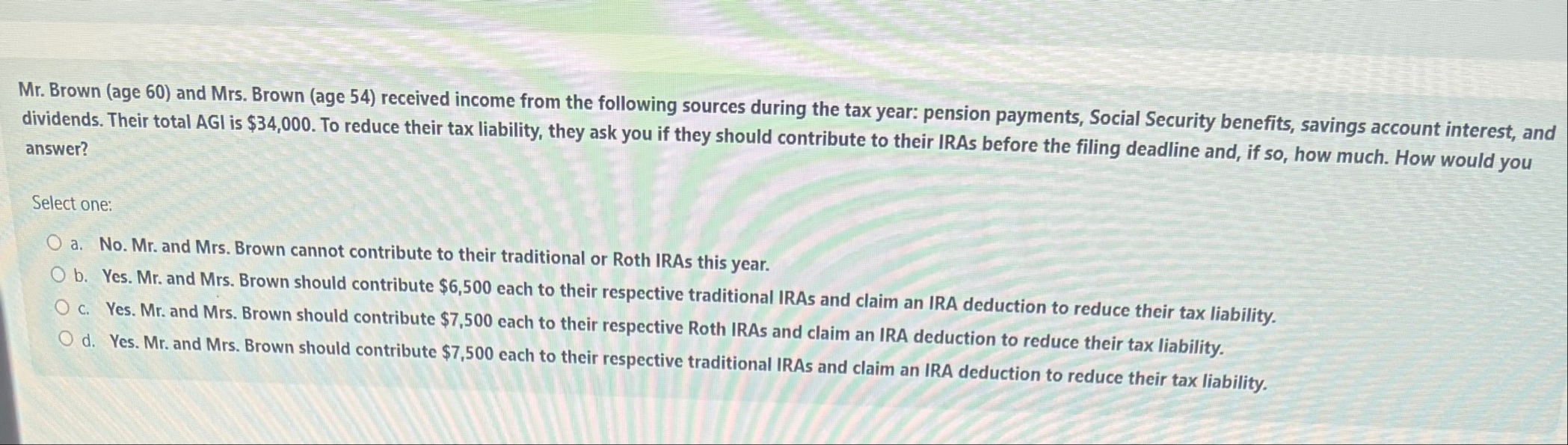

Question: Mr . Brown ( age 6 0 ) and Mrs . Brown ( age 5 4 ) received income from the following sources during the

Mr Brown age and Mrs Brown age received income from the following sources during the tax year: pension payments, Social Security benefits, savings account interest, and dividends. Their total AGI is $ To reduce their tax liability, they ask you if they should contribute to their IRAs before the filing deadline and, if so how much. How would you answer?

Select one:

a No Mr and Mrs Brown cannot contribute to their traditional or Roth IRAs this year.

b Yes. Mr and Mrs Brown should contribute $ each to their respective traditional IRAs and claim an IRA deduction to reduce their tax liability.

c Yes. Mr and Mrs Brown should contribute $ each to their respective Roth IRAs and claim an IRA deduction to reduce their tax liability.

d Yes. Mr and Mrs Brown should contribute $ each to their respective traditional IRAs and claim an IRA deduction to reduce their tax liability.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock