Question: Mr. Chan (a private banking client) would like to add exposure on Hang Seng Index after the sharp year- to-date correction. He would like

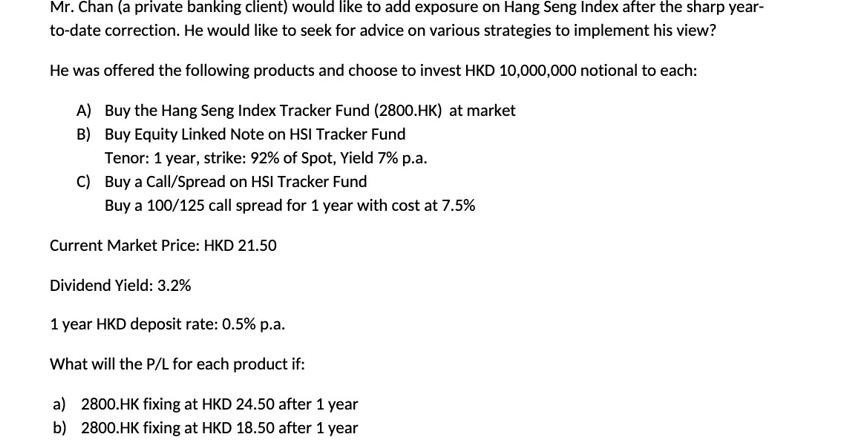

Mr. Chan (a private banking client) would like to add exposure on Hang Seng Index after the sharp year- to-date correction. He would like to seek for advice on various strategies to implement his view? He was offered the following products and choose to invest HKD 10,000,000 notional to each: A) Buy the Hang Seng Index Tracker Fund (2800.HK) at market B) Buy Equity Linked Note on HSI Tracker Fund Tenor: 1 year, strike: 92% of Spot, Yield 7% p.a. C) Buy a Call/Spread on HSI Tracker Fund Buy a 100/125 call spread for 1 year with cost at 7.5% Current Market Price: HKD 21.50 Dividend Yield: 3.2% 1 year HKD deposit rate: 0.5% p.a. What will the P/L for each product if: a) 2800.HK fixing at HKD 24.50 after 1 year b) 2800.HK fixing at HKD 18.50 after 1 year

Step by Step Solution

3.33 Rating (144 Votes )

There are 3 Steps involved in it

To calculate the PL for each product we need to first calculate the initial investment for each prod... View full answer

Get step-by-step solutions from verified subject matter experts