Question: Mr . Cypress owned a small three - unit apartment building in Detroit, Michigan. The rent on each apartment was $ 1 , 0 0

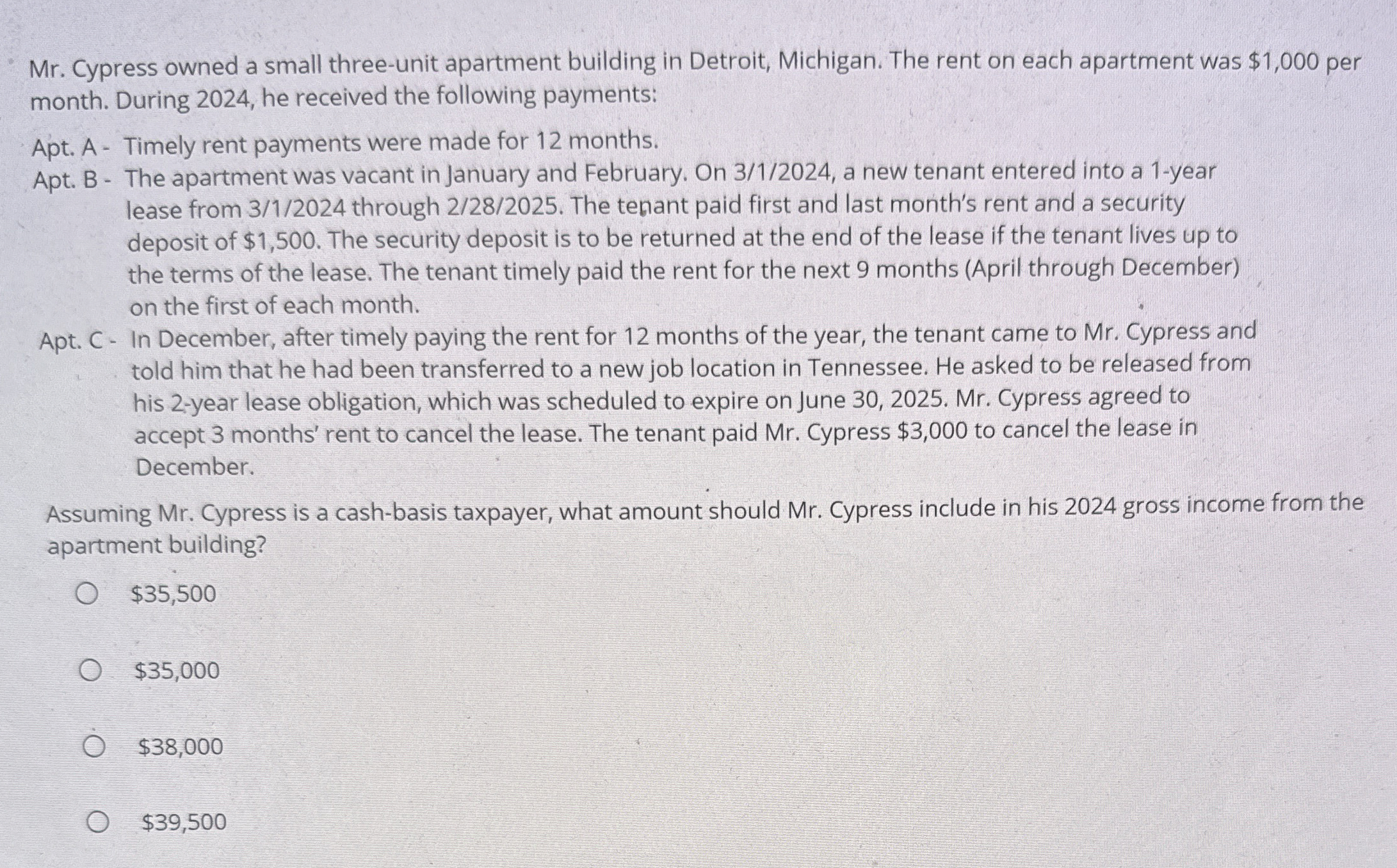

Mr Cypress owned a small threeunit apartment building in Detroit, Michigan. The rent on each apartment was $ per

month. During he received the following payments:

Apt. A Timely rent payments were made for months.

Apt. B The apartment was vacant in January and February. On a new tenant entered into a year

lease from through The tenant paid first and last month's rent and a security

deposit of $ The security deposit is to be returned at the end of the lease if the tenant lives up to

the terms of the lease. The tenant timely paid the rent for the next months April through December

on the first of each month.

Apt. C In December, after timely paying the rent for months of the year, the tenant came to Mr Cypress and

told him that he had been transferred to a new job location in Tennessee. He asked to be released from

his year lease obligation, which was scheduled to expire on June Mr Cypress agreed to

accept months' rent to cancel the lease. The tenant paid Mr Cypress $ to cancel the lease in

December.

Assuming Mr Cypress is a cashbasis taxpayer, what amount should Mr Cypress include in his gross income from the

apartment building?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock