Question: Mr Derrick, age 28, is working as an electrical engineer at Best Berhad. He has a reasonably secure job with good knowledge of financial matters.

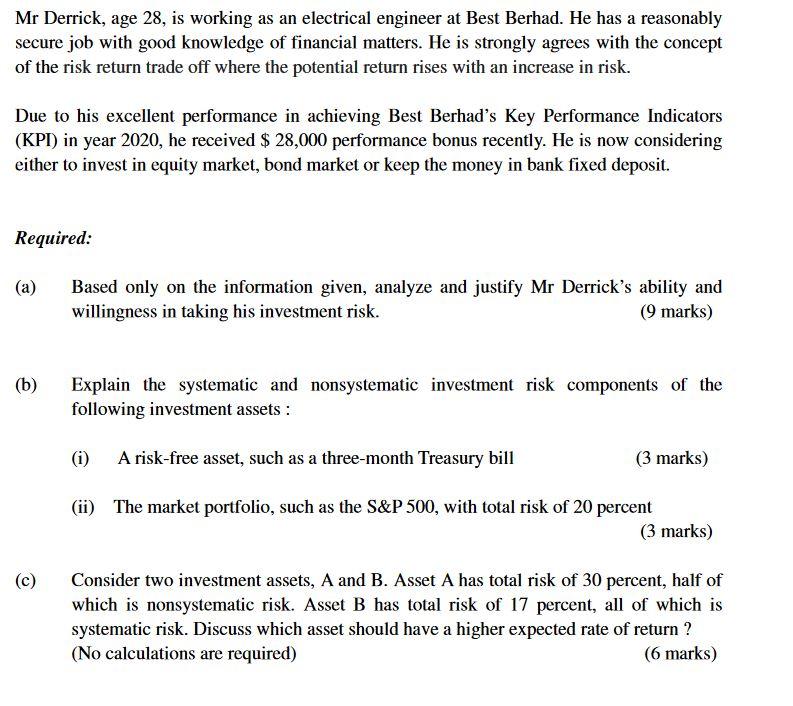

Mr Derrick, age 28, is working as an electrical engineer at Best Berhad. He has a reasonably secure job with good knowledge of financial matters. He is strongly agrees with the concept of the risk return trade off where the potential return rises with an increase in risk. Due to his excellent performance in achieving Best Berhad's Key Performance Indicators (KPI) in year 2020, he received $ 28,000 performance bonus recently. He is now considering either to invest in equity market, bond market or keep the money in bank fixed deposit. Required: (a) Based only on the information given, analyze and justify Mr Derrick's ability and willingness in taking his investment risk. (9 marks) (b) Explain the systematic and nonsystematic investment risk components of the following investment assets : (i) A risk-free asset, such as a three-month Treasury bill (3 marks) (ii) The market portfolio, such as the S&P 500, with total risk of 20 percent (3 marks) (c) Consider two investment assets, A and B. Asset A has total risk of 30 percent, half of which is nonsystematic risk. Asset B has total risk of 17 percent, all of which is systematic risk. Discuss which asset should have a higher expected rate of return? (No calculations are required) (6 marks) Mr Derrick, age 28, is working as an electrical engineer at Best Berhad. He has a reasonably secure job with good knowledge of financial matters. He is strongly agrees with the concept of the risk return trade off where the potential return rises with an increase in risk. Due to his excellent performance in achieving Best Berhad's Key Performance Indicators (KPI) in year 2020, he received $ 28,000 performance bonus recently. He is now considering either to invest in equity market, bond market or keep the money in bank fixed deposit. Required: (a) Based only on the information given, analyze and justify Mr Derrick's ability and willingness in taking his investment risk. (9 marks) (b) Explain the systematic and nonsystematic investment risk components of the following investment assets : (i) A risk-free asset, such as a three-month Treasury bill (3 marks) (ii) The market portfolio, such as the S&P 500, with total risk of 20 percent (3 marks) (c) Consider two investment assets, A and B. Asset A has total risk of 30 percent, half of which is nonsystematic risk. Asset B has total risk of 17 percent, all of which is systematic risk. Discuss which asset should have a higher expected rate of return? (No calculations are required) (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts