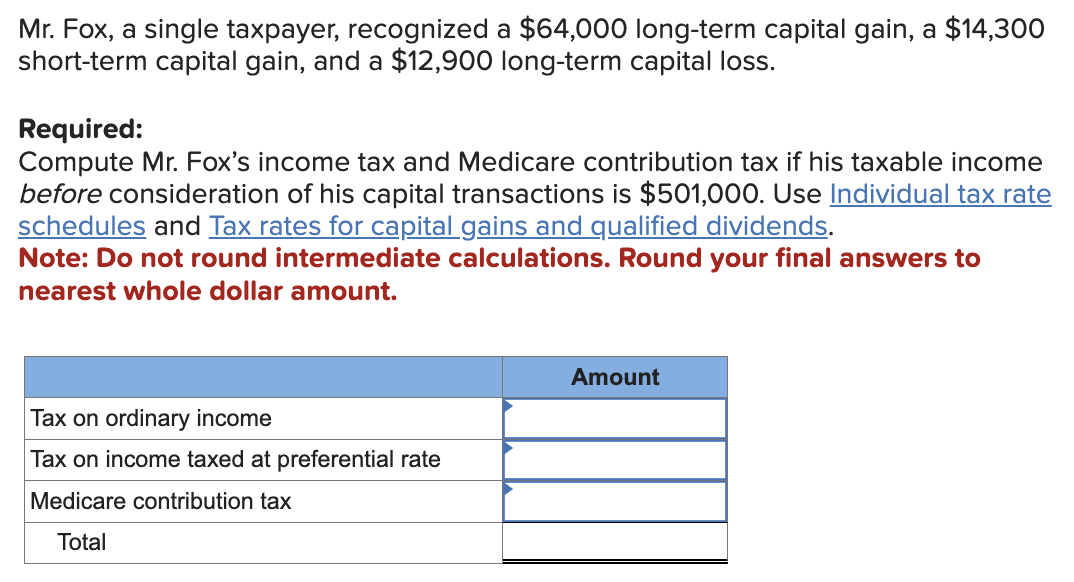

Question: Mr . Fox, a single taxpayer, recognized a $ 6 4 , 0 0 0 long - term capital gain, a $ 1 4 ,

Mr Fox, a single taxpayer, recognized a $ longterm capital gain, a $ shortterm capital gain, and a $ longterm capital loss.

Required:

Compute Mr Foxs income tax and Medicare contribution tax if his taxable income before consideration of his capital transactions is $ Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends.

Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.Mr Fox, a single taxpayer, recognized a $ longterm capital gain, a $

shortterm capital gain, and a $ longterm capital loss.

Required:

Compute Mr Fox's income tax and Medicare contribution tax if his taxable income

before consideration of his capital transactions is $ Use Individual tax rate

schedules and Tax rates for capital gains and qualified dividends.

Note: Do not round intermediate calculations. Round your final answers to

nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock