Question: Mr. Lawrence had been the manager at Pleasure Sdn Bhd (PSB) since 1 February 2016. His employment was terminated on 30 April 2021 due

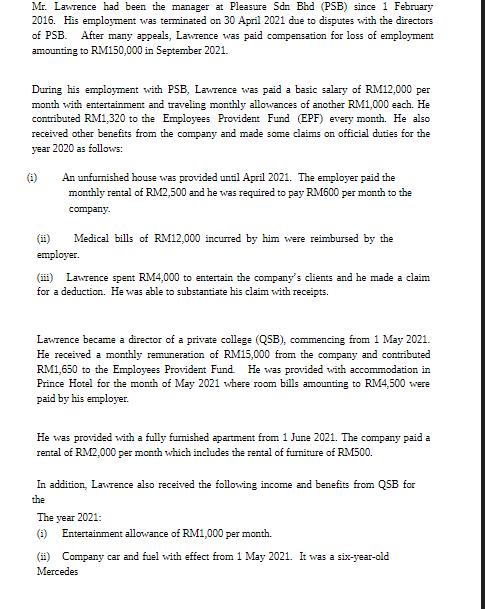

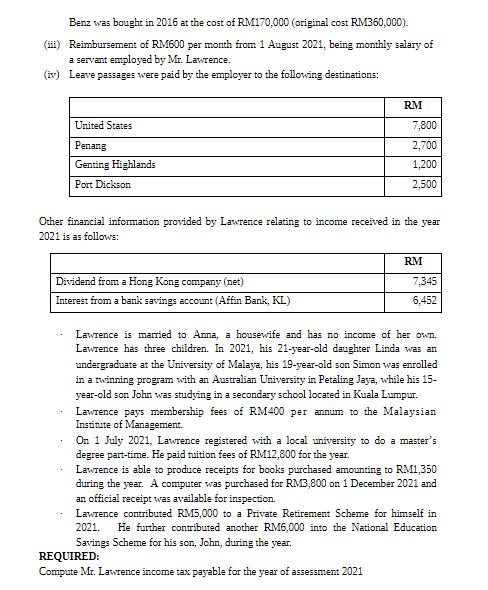

Mr. Lawrence had been the manager at Pleasure Sdn Bhd (PSB) since 1 February 2016. His employment was terminated on 30 April 2021 due to disputes with the directors of PSB. After many appeals, Lawrence was paid compensation for loss of employment amounting to RM150,000 in September 2021. During his employment with PSB, Lawrence was paid a basic salary of RM12,000 per month with entertainment and traveling monthly allowances of another RM1,000 each. He contributed RM1,320 to the Employees Provident Fund (EPF) every month. He also received other benefits from the company and made some claims on official duties for the year 2020 as follows: (1) An unfurnished house was provided until April 2021. The employer paid the monthly rental of RM2,500 and he was required to pay RM600 per month to the company. Medical bills of RM12,000 incurred by him were reimbursed by the employer. (iii) Lawrence spent RM4,000 to entertain the company's clients and he made a claim for a deduction. He was able to substantiate his claim with receipts. Lawrence became a director of a private college (QSB), commencing from 1 May 2021. He received a monthly remuneration of RM15,000 from the company and contributed RM1,650 to the Employees Provident Fund. He was provided with accommodation in Prince Hotel for the month of May 2021 where room bills amounting to RM4,500 were paid by his employer. He was provided with a fully furnished apartment from 1 June 2021. The company paid a rental of RM2,000 per month which includes the rental of furniture of RM500. In addition, Lawrence also received the following income and benefits from QSB for the The year 2021: (1) Entertainment allowance of RM1,000 per month. (ii) Company car and fuel with effect from 1 May 2021. It was a six-year-old Mercedes Benz was bought in 2016 at the cost of RM170,000 (original cost RM360,000). (iii) Reimbursement of RM600 per month from 1 August 2021, being monthly salary of a servant employed by Mr. Lawrence. (iv) Leave passages were paid by the employer to the following destinations: United States Penang Genting Highlands Port Dickson Dividend from a Hong Kong company (net) Interest from a bank savings account (Affin Bank, KL) RM Other financial information provided by Lawrence relating to income received in the year 2021 is as follows: 7,800 2,700 1,200 2,500 RM REQUIRED: Compute Mr. Lawrence income tax payable for the year of assessment 2021 7,345 6,452 Lawrence is married to Anna, a housewife and has no income of her own. Lawrence has three children. In 2021, his 21-year-old daughter Linda was an undergraduate at the University of Malaya, his 19-year-old son Simon was enrolled in a twinning program with an Australian University in Petaling Jaya, while his 15- year-old son John was studying in a secondary school located in Kuala Lumpur. Lawrence pays membership fees of RM400 per annum to the Malaysian Institute of Management. On 1 July 2021, Lawrence registered with a local university to do a master's degree part-time. He paid tuition fees of RM12,800 for the year. Lawrence is able to produce receipts for books purchased amounting to RM1,350 during the year. A computer was purchased for RM3,800 on 1 December 2021 and an official receipt was available for inspection. Lawrence contributed RM5,000 to a Private Retirement Scheme for himself in 2021. He further contributed another RM6,000 into the National Education Savings Scheme for his son, John, during the year.

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

1 Employment Income from PSB JanApr 2021 Basic salary RM12000 per month For 4 months So RM12000 x 4 RM48000 Entertainment allowance RM1000 per month F... View full answer

Get step-by-step solutions from verified subject matter experts