Question: Mr . Li is employed by BDF , Incorporated. Required: a . Compute BDF ' s 2 0 2 4 employer payroll tax with respect

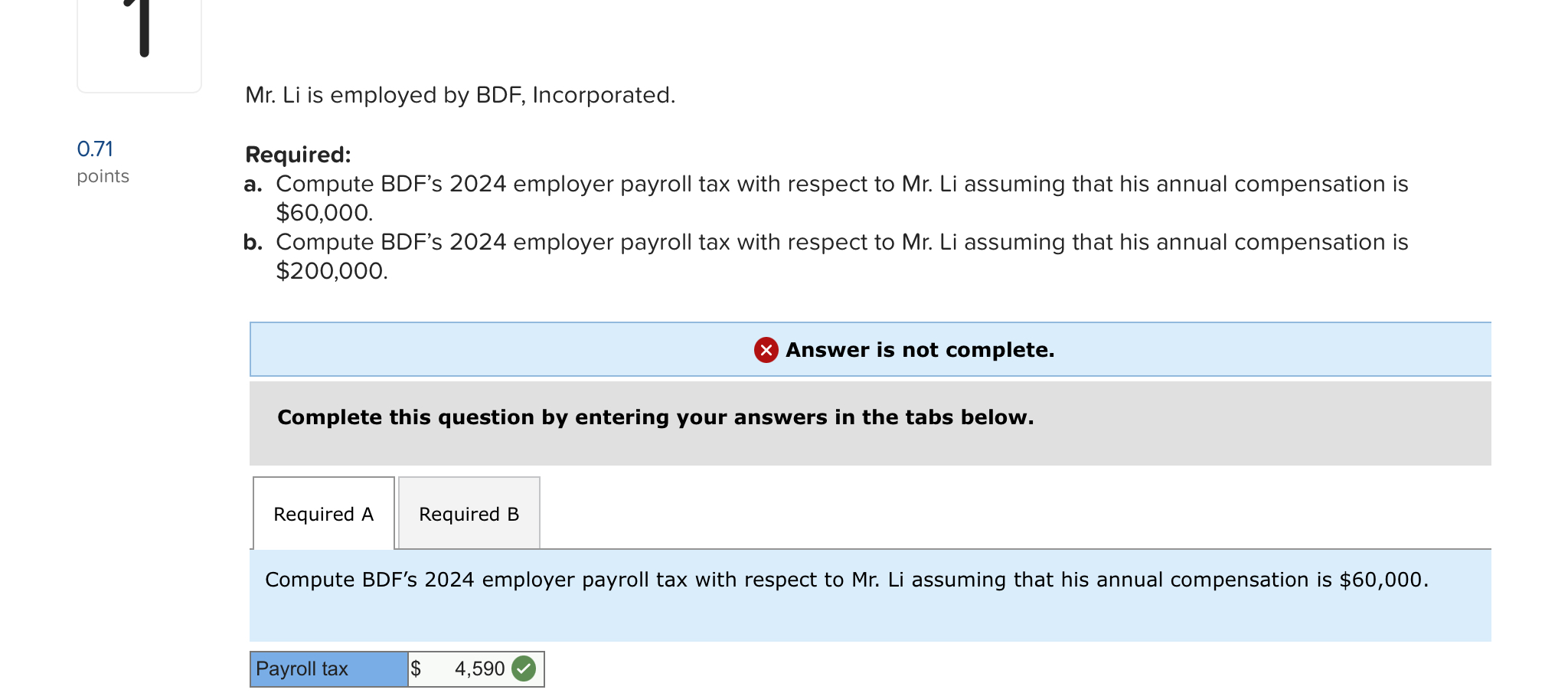

Mr Li is employed by BDF Incorporated. Required: a Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $ b Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $ Answer is not complete. Complete this question by entering your answers in the tabs below. Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $ Mr Li is employed by BDF Incorporated. Required: a Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $ b Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $ Answer is not complete. Complete this question by entering your answers in the tabs below. Compute BDFs employer payroll tax with respect to Mr Li assuming that his annual compensation is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock